Stocks Vs Bonds: What’s The Smarter Choice?

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

If you’re new to investing, you might have heard a lot of friends and your fellow investors telling you to invest heavily in stocks, stocks and only STOCKS.

Then one fine day when the stock market crashes, you lose your money and hit the streets, you meet an old man who tells you to Diversify Your Investment, and he also suggests investing in Bonds, Golds, and other investments.

If you don’t have enough money to invest but you want to invest your money, here’s an article on 17 ways you can invest with little money that will help you.

Wait, What’re bonds? Are they James Bond shares? Are James Bond shares really low risk & high profits?

Before you go all bonkers and change your name to Agent B (secret agent) let’s understand what are stocks and bonds, what’s the difference between the two, and which one should you choose to maximize your returns. Just curious, Stocks vs Bonds, what would you prefer?

Let’s take a small example:

A company wants to raise money for its growth and expansion. The most important thing it needs is money.

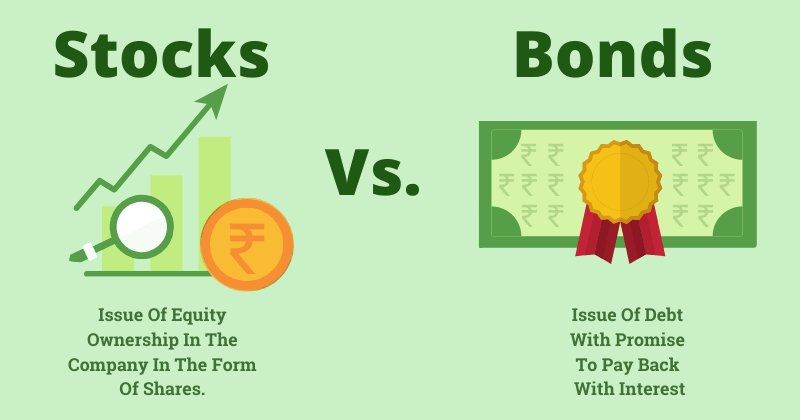

Out of the many ways it can raise money, the two most common ways to get the money they need are either by issuing stocks or by issuing bonds.

If the company wants to give its shares to investors, it will raise stocks. But if they have already issued stocks previously or want to raise money by using debt (loan), they will prefer raising bonds.

What Is The Stock Market

The stock market is a place where investors go to buy and sell shares (i.e stocks) of a corporation with the intention of making profits.

Quick Fact: In India, the prominent stock exchanges are the Bombay stock exchange (BSE) and the National Stock exchange (NSE).

Owning a stock of a company simply means owning a part of the company, a percentage of the company, it can be a small percentage but it’s a share of the company which belongs to you.

Here’s how it works: Let’s say a company works its way up to and reaches a point where it can be called a successful company.

Now the owner wants to expand but is unable to do so as the profits of the company aren’t enough to expand the business.

In such cases, one way to raise money is by making your company public, which means anyone can buy and sell a part of your company.

This is known as Initial Public Offering (IPO) and is generally done by companies to raise money for its expansion.

Isn’t that smart!?

The Bond Market

The Bond market is a place where investors go to buy and sell debt securities issued by corporations and governments with the intention of making a profit out of these debt securities.

Issuing bonds is another way for corporations to raise money for expansion and growth.

Basically, by buying a bond you are lending your money to the government or a corporation for a set period and a fixed rate of interest on your money – it works the same way a fixed deposit account works in a bank.

Depending on the terms and conditions of the bonds, interest can be paid at maturity or specific intervals.

The great thing about the bond market is that it provides the investor income consistently, it can be every month, quarterly basis, and half-yearly basis.

Another great thing about bonds is that they are tax-free, meaning you don’t have to pay tax for bonds that are under the Tax-free Bonds (provided your country has a tax-free bond rule).

Bonds are a safer way to invest as compared to stocks because they provide you with a steady though nominal source of income.

Many investors prefer buying or investing in the bond market for their long-term goals like retirement or their child’s education.

As the risks involved in bonds are minimal, every investor should have a few bonds in their investment portfolio.

Related: 11 Reasons Why You Should Invest In Physical Gold

What’s The Difference Between A Stock And A Bond?

| Pointers | Stocks | Bonds |

|---|---|---|

| Meaning | A Stock (also known as equity) is a financial security that represents the ownership of a corporation | A Bond is a fixed income instrument that represents a debt (loan) made by an investor to a borrower |

| Position | Owners of the firm | Lenders to the firm |

| Issuers | Corporates | Governments or Financial institutions, companies, etc. |

| Market | Over the counter | Centralized stock market |

| Risk Level | Highly risky | Less risky |

| Type Of Investment | Equity | Debt |

| Maturity Date | Depends on investor | Specific time period predecided |

| Owners Are Called | Stockholders/Shareholders | Bondholders |

In stocks, each share you own represents ownership in the company – meaning you share in the profit and losses of the company.

If you have invested in stocks of a particular company and that company makes profits, you make a profit on your investment.

Similarly, if a particular company makes losses and you own a part of that company, you bear those losses too.

Worst case scenario, a company gets insolvent meaning the company cannot pay its debts and thus decides to shut down the company.

In such a situation, you won’t even get back the money you invested, the value of your shares will fall drastically, or may even become zero.

Bonds, on the other hand, don’t provide ownership of the company. They act as loans that will be repaid after a set period.

Bonds lack the amazing returns which stocks provide but they are preferred by those investors who need a regular flow of income.

They tend to fluctuate sometimes due to inflation risks, interest risks, market risks, or credit risks but the vast majority of bonds always end up paying in full at the time of maturity.

Bonds are also much less risky than stocks so it can be a better choice for safe investors.

Why Should I Buy Stocks Over Bonds?

Investors who like to invest for the long term and are okay with short-term risks should opt for stocks in their portfolio.

Depending on your risks you can choose small-cap, medium-cap, or large-cap stocks.

The rate of returns provided by stocks is much better than bonds but that isn’t always true. If a company performs badly, the company stocks fall.

Nifty 50 which contains the top 50 companies in India has given an average annual return of 12.5% in the past 15 years.

Why should I Buy Bonds Instead Of Stocks?

Investors who like to reduce risk & uncertainty and who are comfortable with slightly lower returns should opt for Bonds in their portfolio.

The rate of return provided by bonds is better than a savings account. You should opt for Tax-free Bonds as these bonds ensure you don’t pay tax during the maturity of the bond.

Once the bonds reach maturity, you get the money you invested along with interest accrued during the period.

The average return on bonds for 5 – 10 years held in a period is approximately 7% annually.

Advantages & Disadvantages of Stocks & Bonds

Advantages Of Stocks

- Great returns on investment

- Ownership stake in the company

- May pay dividends & bonuses

Disadvantages Of Stocks

Here’s Why Investing in Stocks Is A Bad Idea:

- High volatility

- No guaranteed returns

- Too risky

- Needs too much company knowledge

Advantages Of Bonds

Investing in bonds is a smart option and here’s why:

- Lesser Volatility compared to stocks

- Can provide timely income

- High liquidity and stability

Disadvantages Of Bonds

You should not invest in bonds if you don’t like the below pointers:

- Lower long term returns when compared to stocks

- They are subject to risk, the prices can fall due to a few factors like interest rate.

- Holding too many bonds will reduce your profit-making capacity.

General FAQS

How Much To Invest In Stocks And Bonds By Age (Chart)

As far as how much you should invest in stocks, the answer varies from person to person but as a basic rule of thumb, don’t exceed any investment (especially stocks) more than 50% of your entire investment portfolio.

If you’re young, you can take more risks and maybe….maybe invest more than 50% in stocks. If you’re old, lowering stock investments and upping other safer investments is a great idea. So how much to invest in bonds? I’d say refer to my chart below!

| Age | Stocks | Bonds |

|---|---|---|

| 0 – 30 | 80% | 20% |

| 40 | 70% | 30% |

| 50 | 60% | 40% |

| 55 | 50% | 50% |

| 60 | 40% | 60% |

| 65 and above | 30% | 70% |

Is Investing In Stocks Like gambling?

Investing in stocks is gambling only if you’re blindly investing. If you pick stocks based on some random investor’s advice, you’re calling for trouble.

There are a few investors that teach you to identify good stocks, learn those techniques and then decide whether a stock is good or not.

If you decide based on facts and figures, the stock market becomes less of a gambling centre and more of a strategy money-making centre. I have an article on the Top 5 Stock Market Strategies For Beginners, check it out.

What Can I Buy If Not Stocks & Bonds?

Do a google search and you’ll find at least 5 different investments to lay your egg in. I’ll name the ones I know – Real Estate, Gold & other metals, Commodities, Forex, Fixed Deposits/Certificate of Deposits.

Here are a few articles that should help you find other investment options:

Are Bonds A Good Investment in 2024?

Bonds are the safest investments with the best returns right now. Yeah, their returns are lower than the stock market returns but are much safer and thus bring less risk.

If you’re retired or are heading towards retirement soon, shifting a larger portion out of stocks and into bonds or Certificate of deposit/Fixed deposits might be a good investment decision for you.

Are Bonds A Good Investment in 2024?

Bonds are the safest investments with the best returns right now. Yeah, their returns are lower than the stock market returns but are much safer and thus bring less risk.

If you’re retired or are heading towards retirement soon, shifting a larger portion out of stocks and into bonds or Certificate of deposit/Fixed deposits might be a good investment decision for you.

Which Is Better: Stocks Or Bonds?

Stocks are good if you want high risks and your sole purpose is to gain maximum profits. While bonds are useful if your goal is to secure your money and to ensure you don’t lose their value.

Bonds offer lower risk and are preferred if you hate taking huge risks. Even bonds have some risk so don’t assume that they’re risk-free investments.

Do Bonds Go Up When Stocks Go Down?

We’ve seen time and again that the stock market and the bond market have an inverse relationship. But that’s not true.

There is no logical explanation for this, we have also seen that when stock prices go up, so do bond prices, and when stock prices go down, even bond prices have fallen in the past. This is a myth nothing more than that.

Do You Need A Lot Of Money To Invest?

The million-dollar question arises, do you need to have a lot of money to make a lot of money if you’re gonna invest in The Stock Market?

You don’t need a lot of money. You can invest with little money and still make decent profits on your investments. Mutual funds offer an investor a chance to invest and extremely little money into the stock market and other markets.

If you’re low on money, I suggest you should look at mutual funds as your entry to gain profits.

Stocks Vs Bonds: Conclusion

Smarter investors know that you should invest in the stock market as well as the bond market. Stocks are riskier but bonds balance the risks involved.

Bonds provide lower rates of returns to investors which are balanced out by buying stocks that provide high interest rates. In all, you have a balanced portfolio.

If you want to take a little more risk, you can prefer 60% stocks and 40% bonds, but if you prefer less risk and more safe investments, you can prefer 60% bonds and 40% stocks.

Each one has its pros and cons as you’ve read above. One should do proper research before buying stocks or bonds.

To diversify your risk, you should have both of these investments in your portfolio.

Do you invest in the bond market or the stock market or a mixture of both? Let’s discuss your favorite investment in the comments.

If you found this post helpful, I’ll be super happy if you share it with your friends and family.

After all, sharing is caring, and my goal with this blog is to share my knowledge with everyone! Thank you.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!

Your means of explaining everything in this paragraph is

really fastidious, all be capable of effortlessly understand it,

Thanks a lot.

That means a lot. It takes a lot of work to get these done. I’m so glad you’re finding my content useful 🙂

It’s an remarkable paragraph designed for all the web

visitors; they will get advantage from it I am sure.

Thank you Cuadros. Have a great day!

It is appropriate time to make some plans for the future and it’s time to be happy.

I have read this post and if I could I wish to suggest you some interesting things or tips.

Maybe you can write next articles referring to this article.

I wish to read even more things about it!

I would love to hear some tips and article topics from you! Share it here and I promise you I shall try my best to write articles on those topics