Recession: What is it? 9 Ways To Prepare

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

Recession: What is it?

A recession is a period of economic decline where the economic performance of a country sees a significant drop which may last for months or even years.

A recession occurs when a country’s or the world’s economic growth stops and begins to shrink rapidly.

Surely you can’t predict when the next recession hits everyone nor can you do anything to avoid it. It hits everyone and is inevitable.

Companies face huge losses during this time, and that’s why companies fire people to cut costs resulting in higher levels of unemployment.

This increases unemployment and various small and medium scale businesses start facing losses.

How long do recessions last?

The last recession we faced was in the year 2007 and lasted more or less 18 months from 2007-to-2009 It was called the Great Recession, which wreaked havoc on millions as they faced a critical financial crisis.

Some couldn’t even pay for basic food or pay their rent and were thus homeless. A recession can be smaller or larger than 18 months depending on the impact it creates on the global economy.

Should you prepare yourself for The Recession?

Yes, Without a doubt! Recessions are inevitable but that doesn’t mean you can’t prepare for it. The following ways to prepare for a recession will help you do just that.

9 Ways To Recession-Proof Your Life

1. Preserve Your Investments

I have seen so many people sell all their investments when a tragic incident takes place. I know that in a recession, you might have low money and thus you need to liquidate your investments, just make sure you sell some and keep the rest.

If you worry that your investments won’t generate profits, remember that investing is a long-term play where short-term losses don’t have a drastic effect on the ROI earned. If the market is down right now, once the recession is over the market will rise back up and you will surely make your profits. So Hold It, Don’t Sell It.

2. Offer Solutions to Problems

If you’re having financial problems and you can’t pay your rent to the landlord, surely negotiating is a great way to ease up your problem, but there is a better way than negotiating.

During a recession every person will face some kind of problem, even the rich face problems, they are just different from our problems. Your work is to find out what problem your landlord is currently facing and solve that problem for him.

By doing this, the landlord will be happy that his problem is solved and will help you out. They might even allow you to delay your payments by a month or two. For example, your landlord has a newborn child and the doctor has advised them to only feed the child fresh organic fruits, nothing else.

The store he used to visit to buy organic fruits was shut down due to the recession. You see this problem and approach the landlord by telling him that your family grows fresh organic fruits in their native place, you can get it for him for free. The landlord will be extremely happy and in turn, will let you pay the rent after a month.

3. Be Open to Any Job

If you’re unemployed either because you were fired or your company became insolvent, it’s time to get a new job right away. Just because you were working as a strategic manager for a big firm before being unemployed doesn’t mean you need to find another high-paying job.

Good jobs take some time to come. If you wait that long, you might lose a lot of money you could’ve made in that time frame.

“No job is beneath you. The only thing which should be beneath you is your EGO.”

Take up low-paying jobs and work your way up the ladder, I know it sounds bad but you have to do something to earn money during a recession. Low-paying jobs may not be that great but you don’t know the new opportunities and doors it can open for you. Take any job you get and constantly keep applying to the kind of jobs you want.

4. Use the Power of the Internet

Google it up! Do you have a problem you’re facing? Use Google to find the solution. Have a loan that you can’t pay during the recession? Ask Google and see what suggestions you get. Want to make more money? There are countless legitimate websites to make money online, from filling out survey forms to selling your services on Fiverr.

You can start a new business online, teach students, and play games to make money. Don’t have financial problems? Great then learn a new skill, and put it up on LinkedIn, companies will love to hire you if you possess a new skill set. The internet has the answer to almost anything, so use it to find new ways to solve your problems.

5. Capitalize on Stock Market Opportunities

During an economic slowdown, the stock market crashes, and even the best companies take a massive hit, instead of being disappointed that the stocks you own are in loss, you should be happy that you can now buy the same stocks for way cheaper than it will be.

Note: once the recession is over, companies will try even harder to grow and expand in the market even if they have had losses. So they will work even harder to increase their company’s profits drastically. This, in turn, makes you rich! The takeaway – Buy some stocks.

Buying the shares at a low price ensures that when the market is back on track you instantly make a profit on your investments. The best way to make money is to buy when the market is down and when everyone is focused on selling – You Buy!

6. Trim Your Expenses

It’s said that A penny saved is a penny earned. Now I know that a penny won’t be able to solve your financial crisis but during tough times, every single penny counts!

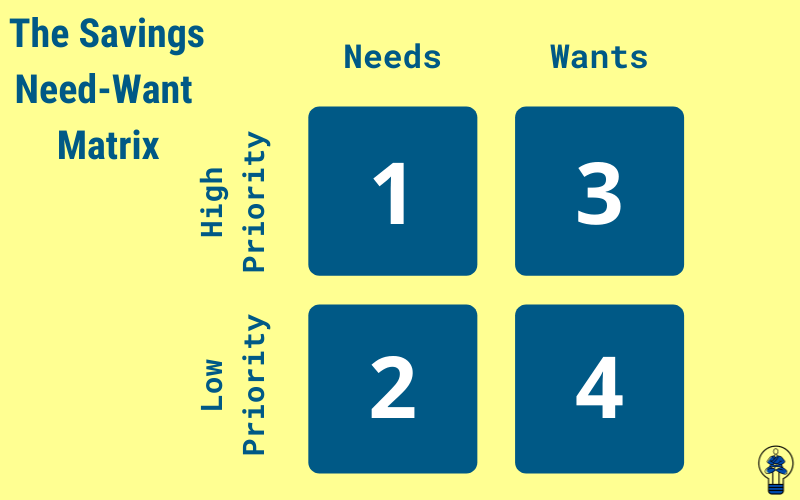

Yes, you need to cut down on your expenses. The problem is quite often we don’t know what we need, that’s why understanding the difference between a Need and a want is crucial.

A Need is something without which your life will be quite difficult, possibly impossible, you need it to survive. A want is something that provides you with gratification and happiness, it usually isn’t necessary and you can surely survive without a want.

But that doesn’t mean you stay like a stone-age man! The following table might help you understand how to prioritize between Needs and Wants with ease.

Your priorities should go on like this:

- Need and High-priority

- Need and Low-priority

- Want and High-priority

- Want and Low-priority

This table should help you understand how you should allocate your needs and wants easily.

7. Limit Credit Card Usage

The economy is at its worst time and when everyone is facing financial problems, you want to spend money using your credit card! Don’t be a fool, maybe you didn’t lose your job during the recession but that doesn’t mean you won’t lose it in a week or a month, maybe your company won’t pay you your salary because they are at a loss due to the great recession.

What I’m implying is you can’t predict what can happen, especially when everyone is facing heavy losses, stop wasting money and that means Don’t Touch Your Credit Card!

8. Maintain A High Credit Score

Didn’t I just tell you to not use credit cards at all? Yes, I did, but what if you don’t have any other option? You need to sustain yourself somehow right? In such cases having a high credit score helps a lot. You can easily get approved for a small loan at a much lower interest rate if you have a high credit score.

Few companies also have additional perks for those with high credit scores. The easiest way to maintain a high credit score is by paying all your bills and any sort of debt on or before the due date.

Keeping a high credit score at all times is a must.

9. Seek Help When Needed

If you’ve tried the above steps and you still can’t survive financially, ask someone for help. Just make sure they aren’t facing any financial problems.

Often, people who have money during bad times help those who don’t, all you’ve got to do is Ask. If all fails don’t hesitate to ask someone you know or a stranger for some financial help, I’m quite positive they’ll help you out.

Can You Make Money In A Recession?

Hell yeah! Anyone can make money during a recession. If you have some money and a desire to make money, here are two ways to make money during the recession:

1. Start a business

You need to understand a concept first.

Every action has an equal and opposite reaction – Newton’s Third law.

This if most of the companies are making huge losses during a recession, there have to be a few companies who make a lot of profits. Let’s take COVID-19, for example, almost all companies have faced heavy losses but there are a few industries like the Toilet Paper industry which has grown over 190%.

Industries such as Grocery delivery services, the Medicine industry, online education, and e-learning have seen massive growth in terms of customers and profits generated.

My point, starting a small-scale company in a sector that is growing during a recession will surely reduce your financial burdens and make you money. Remember “The best businesses are started during the worst times”. Starting a business now might be the only step left to take you to riches.

2. Invest in Discounted & Good Stocks

I’ve already explained this above, but to be clear – Buy stocks of those companies that you know always perform well and which have taken a massive hit during a recession.

Make a list of 10-15 such companies and buy these stocks in bulk. Surely you won’t make profits for at least a year, give it at least two years and you’ll start seeing amazing results.

Sage Tip: Continue investing normally as you would when the market is good, if possible, invest more than you normally invest.

How To Prepare For A Recession?

A few habits and mental aspects to follow during a recession:

- Don’t panic

- Practice yoga and meditation daily

- Watch some comedy series and exercise laughing.

- Don’t take too much stress, relax and stay calm.

Being calm is probably the most important thing you should do during a recession.

Most people create so much chaos and panic that instead of finding ways to solve their problems and end their sorrows, they create new problems and increase their stress levels which as we all know does no good!

Be smart, even though you might have serious money problems during a recession, it’s okay!

Don’t stress yourself thinking about your problems, instead, think about how you can overcome these problems – maybe start a business that makes money during a recession like a small marketing agency, or start selling essential commodities in your locality to make some cash.

As great as recessions are to everyone, it’s a great learning opportunity. Most people break out of bad times and become completely new people much stronger and smarter than before.

The best suggestion I can give you is to build an Emergency Fund.

The only way you can financially survive during a recession is if you have an Emergency Fund. It’s like owning a health insurance policy without the need to pay a premium.

A simple rule of thumb is that you need to safely keep aside at least 6 months’ expenses, though it’s okay if you can’t do 6 months, start with a goal of 3 months and gradually hit the 6-month goal.

There are two types of people:

One who does something about the problem at hand. One who thinks about the problem and does nothing to solve it.

Don’t be the latter! Take action to set yourself free from the problem, if that means you need to make money, then do it!

Let me know in the comments below, What strategies would you implement to be financially secure during a recession.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!