6 Money Saving Principles You Ought To Follow

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

Saving money is the foundation of your financial success. Having money saved will provide you with the means to take advantage when necessary.

Whether it is increasing your net worth, going for a beautiful vacation, going back to college for a degree, starting a new business, or even investing in stocks when the market crashes.

There are three essential steps to financial freedom.

- Make Money

- Save money

- Grow money

Saving money is one of the three essential steps to financial freedom. So now we know how important saving some money today can be shortly.

But often when we try to save money, we end up spending more than we wanted to. That’s because when we force ourselves to save money, all our brain thinks of is spending money, thus you find it very hard to resist the temptation to spend, and eventually, you overspend.

To make life simpler, I’ve written down 6 sensible money-saving principles that you can use to save money, be financially free, and not fall into the trap, most people fall into.

Saving money isn’t a short-term play, it’s a well-defined strategic approach towards developing yourself to achieve the financial goals you set while ensuring you don’t end up in misery or end up on the corner of the street.

To have a financially independent life, you need to know a few principles which will help you save your money.

Following are the best Money Saving Principles You Have To Follow

The Fundamental Money-Saving Principles

1. Forget What You Think You Know About Money

The problem with financial advice is there are hundreds of videos on how to make money, how to save money, how to grow money, and how to manage money, but they usually contain information that is either impractical, irrelevant, or wrong.

Due to so much information out there, a normal viewer interprets the wrong approach as the right approach only later crying at the fact that the approach he used failed to work!

So my simple principle is FORGET EVERYTHING YOU LEARNT ABOUT MONEY RIGHT NOW. Follow a few people you know are credible and knowledgeable.

2. The Backward Saving Principle

Peter works as an engineer and earns Rs 10000 a month, he needs to make sure he spends no more than 10000, but that’s not it.

He cannot stay living paycheck to paycheck as Peter can need instant cash at any point in time, thus he needs to calculate how much he has to save first (let’s say his calculations tell him to save Rs 4000 a month) and spend accordingly rather than spending first and then saving. Thus Peter ends up spending the remaining amount (10000-4000=6000).

Following this approach ensures that you hit your priorities first which is to save money.

Many financial experts focus on paying yourself first, but how can you pay yourself first and what does it mean?

Once you get your salary, almost all of us first spend the money and then save the rest.

Paying yourself first emphasizes setting aside some money into another account before spending any money at all. Thus you care for yourself and your future before you spend on luxuries.

But what if the money you are left with isn’t enough to satisfy all of your expenses?

In that case, you need to have an additional source of income, it can be passive but it needs to be generated from outside, not utilized from the money you’ve paid yourself first.

Following this rule alone will guarantee you to achieve your goals faster.

3. Daily Money Saving Strategies

Every day, you will come across something where you will likely wish to spend your money, don’t! Instead, take the money and put it in a piggy bank. You might not realize what saving Rs 50 a day might do for you but just in a year of doing this, you can get Rs 18000 in your piggy bank.

No, I am not insisting on storing all of this money at home. Every month deposit the money in a bank account so that you can at least earn a little bit more through bank interest rates.

Keep reminding yourself that you need to be disciplined, you don’t need to spend Rs 10 or 20 on a vada pav (potato crispy – a mouth-watering Indian dish) or a sandwich.

Now I am not saying don’t spend anything and be a miser; you just got to be alert where you spend the money and if the expense incurred is necessary. If it is then that’s okay, but most often it isn’t.

Small accomplishments each day result in big accomplishments over time so start being aware of the small expenses you have and put a slow and gradual stop to them.

4. Occasional Splurges in Moderation

Yes, we certainly are on a “Let’s save all the money’ goal but we don’t have to be miserable while doing it, right?

To keep things interesting, you should occasionally treat yourself with either some materialistic thing or an experience with your loved one.

Generally, once a month I splurge on dinner with my friends. I like it that way and I get to have my share of excitement. Yes, you can be strict and avoid this for better saving habits, but I feel that spending a bit sometimes helps you continue a goal for a longer time.

If you restrict yourself to everything, chances are you might leave the habit sooner than you wish and now you’re back to square one which is worse than spending a bit sometimes.

5. Distinguishing Needs vs. Wants

What is a Need?

I Need a place to live, I Need food to eat every day, I Need to wear clothes to work. It is something you actually have to have without which there can be serious problems. It’s like a compulsion, you cannot stay without a house nor can you without clothes or live without food to eat.

But do you need a lavish two-bedroom hall kitchen or supreme high-quality goods or branded clothes? These are your wants. We all have needs and wants and quite often can’t distinguish between the two. Issac, your best friend bought an iPhone and now you want one too. You will consider it as a need but in practicality, it is a want.

But, there’s no harm in having a want cause as humans, we can and should satisfy our wants.

So the question remains: How do I figure out what is actually necessary and what is not?

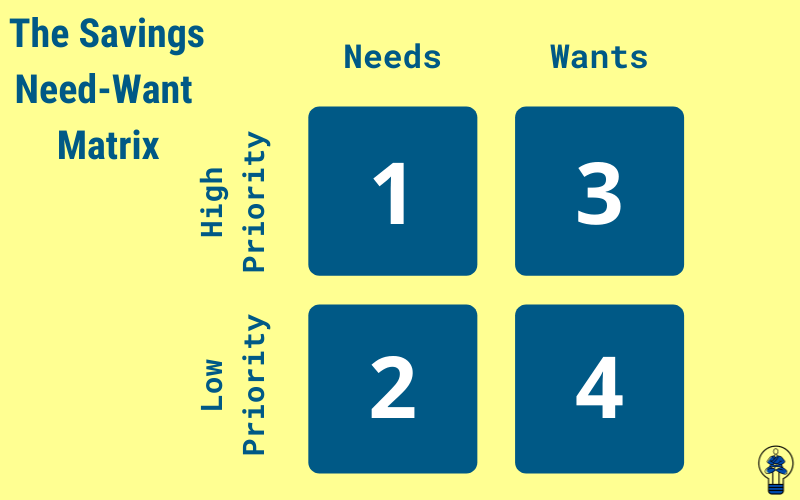

Well, the answer lies in the year 1954 when Eisenhower created the Urgent important matrix. If we tweak it to our advantage, we get the following table.

Let’s go back to the iPhone, here the iPhone comes in the Want and high priority category.

Your priorities should go on like this:

- Need and High-priority

- Want and High-priority

- Need and Low-priority

- Want and Low-priority

Thus we can establish our wants and needs easily. But just because want is a high priority, doesn’t mean it is always a high priority. So before making an impulsive decision, ask someone else for their opinions and think clearly.

6. Meditation For Discipline

By now you know that saving money is nothing but a Habit. Then all you have to make sure is that you consistently follow the habit and don’t break the chain. Nothing can beat a man with discipline.

A few ways to improve your discipline are:

- Know your weaknesses and work towards improving them.

- Remove temptations by freeing your mind and body.

- Practicing Meditation and Yoga.

- Eat healthy and whole foods.

- Schedule breaks and treats for yourself to break the monotony.

According to Dalai Lama, “The very purpose of mediation is to discipline the mind and reduce afflictive emotions”

Thus I urge everyone to include meditation and Yoga in their day-to-day routine so that they become more Disciplined, thus their habits of saving money become more in alignment with you.

Step By Step On How To Save Money

Now that we have cleared out the principles of how you should align your saving goals, let’s take a step-by-step approach to saving money.

1. Create a Monthly Budget

Doesn’t matter if you have worked for two years or you’re just starting, you need to stop and create your monthly budget planner right now.

What is the budget?

A budget is simply a strategy you use to ensure that your income does not exceed your expenses. The main purpose of creating a budget is to have the upper hand in your financial problems. Most Americans live paycheck to paycheck which not only leaves them with no savings but is also quite stressful.

For example – if you create a budget template where you can include all of your expenses and subtract them from your total income, you can not only figure out how much money is left but also how much more you can save. Having a Monthly Budget is a Must!

Top 4 Budgeting apps to track all your expenses:

- Money Manager

- Wallet

- Walnut

- Expense tracker

Any of these apps will be good for preparing a budget and tracking your expenses. I personally like Money Manager because of its simple user interface, but all these four serve the purpose very well. If you don’t like to use an app for your budget, you can also download our Free Basic Budget Template or create your budget template.

2. Track Your Daily Expenses

Once you’ve created a proper budget, it’s time to actively track your spending. Every expense you make needs to be recorded in the budget systematically.

Effective steps to calculate your daily budget:

- Calculate your monthly expenses

- Then divide it by 31 to get your daily limit.

- Ensure you don’t overspend the daily limit at any cost.

- Keep in mind to spend 10-15% less than your daily expenses every day. If your expenses are Rs 6000 a month which is 200 a day. Now Rs 150-160 is what you should be spending each day and the remaining amount should act as an expense reserve for your unexpected monthly expenses

Note: Emergency Fund is not to be used for unexpected monthly expenses. It is only to be used during extreme emergencies.

3. Build an Emergency Fund

An emergency fund is exactly what it sounds like – A specific fund created by putting aside a specific amount every month to ensure that during the financial situation, these funds should help you stay happy and do not create havoc in your life.

If you lose all your money tomorrow, the only thing that will save you is your emergency fund.

I cannot stress enough the importance of having an emergency fund at hand. It is like having a hidden treasure all to yourself. It is like insurance money at your disposal without paying any premium for it.

A few benefits of an Emergency Fund are:

- It helps to avoid taking in debt.

- Creates peace and sanity of mind.

- Ensures financial security for the future.

- You don’t have to depend on friends and family for instant cash.

- If you lose your job tomorrow, you have a backup plan to support you financially.

Generally, an emergency fund should have at least 6 months of living expenses. But as time passes, the amount too should increase due to ever-increasing prices(inflation).

4. Eliminate Long-term Debt

Once you have enough money in your Emergency Fund account, your next focus should be solely on getting rid of all debt. In the U.S., debt has been declared as the worst financial crisis faced by Millennials.

Any long-term debt like a house loan, car loan, student loan, a medical loan should be paid off immediately.

The interest charged on these loans is very high and will definitely eat all of your savings in the long run. If you have debt, you might never be able to save money as debt eats up all your money.

5. Secure Your Retirement

Now that you’ve opened an emergency fund, and stacked money in it to pay off your debt; you can move on to the final step – create another account solely for your retirement.

The sooner you start putting some money away for your retirement, the more that money will grow.

Even though you might invest your money from time to time, creating a retirement account is essential as it is for your future. If you already have a pension plan offered to you by your company, that’s great.

No need for another one but if your company doesn’t offer such a thing, you better create a retirement account for your future right after you pay your debt.

Still, confused about how to save money?

- Here are a few Money Saving Articles you should read to achieve financial freedom.

- How to Save Up For Your Dream Vacation

- Impulsive Buying: How To Stop Impulsive Buying

- How To Save Money: 23 Practical Tips

- 29 Ways To Save Money On Groceries

Read an article a week, it will help you achieve your financial goals faster. But Note, reading it doesn’t mean your financial situation may change. You have to take action to reach your financial goals. These money-saving principles will only help you if you work hard and focus on not giving up.

How to save money?

The fact is that saving money is Difficult. It’s a lifestyle one has to imbibe himself in. There are habits you need to develop, it is not impossible if you focus your attention on achieving your goals.

That is why having a full-proof strategy towards your goals, helps you save money like a Pro.

It all starts with

Tiny steps are taken each day X Years

Small steps taken every day will result in massive financial abundance in the long run.

Key Points – Summary

Principles Of Saving Your Money

- Forget everything you learned about money

- Use the backward principle of Saving Money

- Save some money every day

- Have a day in a month where you can splurge just a bit

- Understand the difference between a need and a want

- Stay Disciplined and start Meditation

Step-by-step approach to How to Save Money

- Making a monthly budget

- Track your spending

- Create an Emergency Fund

- Pay off your debt

- Open a retirement account

Saving money isn’t a child’s play and with the wrong approach, it certainly will lead to disappointment. It takes some serious hard work, smart planning, and a lot of self-control.

But if you’re willing to take that step, a few simple ways to save money could set you up on the path to Financial Security Forever.

Do you save money consistently? If Yes, then what strategies do you use to Save Money? Let’s have a chat down in the comment below.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!