How to Track Your Expenses in 6 Steps

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

Drink some water, calculate your income, then your expenses, cut off a few expenses and you’re set to track your expenses.

You need to know how and where your money is going each month.

Tracking your expenses can give you an accurate number of how much money you have, where you’re spending it, and how you’re going to make sure you don’t have financial problems!

In 6 simple steps, I’ll show you how to track your expenses so that your financial life will remain stable and aimless spending will be something of the past.

Let’s get started!

How to Track Your Expenses in 6 Steps

1. Calculate Your Net Income

Before you do anything, have your net in-house income in your mind.

An accurate number, don’t assume, check how much tax, or loan is cut before you get your correct amount. Your net income is your income after deducting taxes.

Once you have this number, all your expenses will be deducted from this number. Not knowing this number means you’re deducting money from any imaginary number and your calculations will go for a toss.

2. Choose Your Budgeting Tool Wisely

This may make or break your entire Budget, I mean it. You have three options to choose from

Budgeting app

There are many great budgeting apps on the Play Store as well as an Android that you can use to write your expenses and income. Apps like Mint, Mobills Budget Planner, and Money Manager are some of the free yet best ones out there.

YNAB is a paid alternative but it’s a great app and has tons of amazing features.

The best thing about an app is it does most of the work for you and it also provides amazing graphs that help you understand a lot more about how you spend. A few apps also guide you to achieve your financial goals.

Budget Template

Even though an app might be the perfect solution for all your budgeting problems, there are many who either don’t take an app seriously (maybe because it’s on the phone) or just forget to fill in the details or prefer writing it down using a pen & paper.

If you’re that person, don’t worry. Here is an amazing Free Budget Template for you to write it down one by one. If you ask me, I would easily prefer a budget Template over an app as writing my expenses down will make me more attentive towards my expenses.

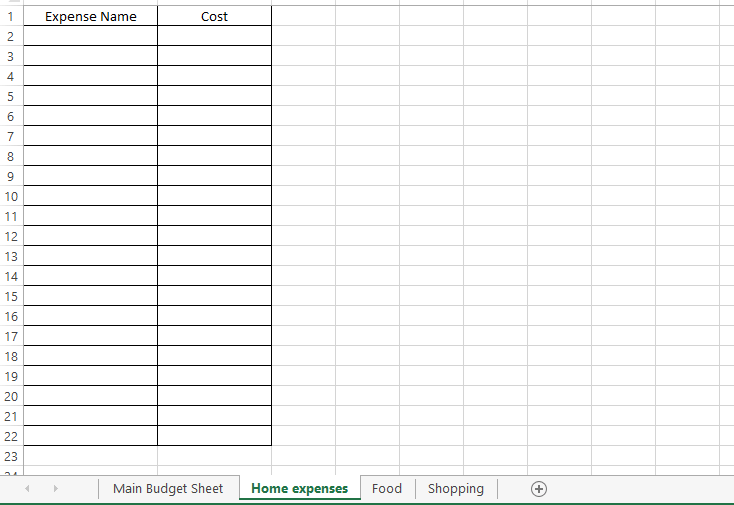

Excel spreadsheet

The good old Excel is a great way for you to like simplicity and speed. The Excel spreadsheet is for that person who doesn’t like the glamour of an app but likes the seriousness of a budget template.

It works the same way as a template.

Here’s how to track your expenses in Excel.

First, you make the Main Budget Sheet (Sheet 1), and then Sheets 2,3,4 will be Category Sheets. Depending on the number of categories, add additional sheets. In each sheet, Expense Name and Cost can be your column names. Fill in the details accordingly.

It’s a great option and it’s easy to understand and make changes when you need to unlike a budget template cause you’ll have to scribble to make changes.

Note: These will only work if you take time to fill in the details, be it an app, a budget template, or an Excel spreadsheet.

All three options work well and will help you achieve financial independence. All you need to do is be disciplined and fill in the details.

3. List and Categorize Current Expenses

Make a list of all the things you spent money on that month.

This includes your rent, maintenance on rent, food expenses, transportation, fun expenses, utilities, credit & debit card expenses, basically, anything that has taken money out of your pocket, that also includes you lending some money to friends and family.

After you’ve written down every expense you made that month, start categorizing them according to your understanding.

Like all groceries and home-cooked food come in the Food category, any outside meals, dine-outs, burgers, and pizzas; club them in the Outside Food Category, Rent and its maintenance – Rent Category.

If you own your home, then Home Expenses Category. Any new furniture or showpieces purchased by you come under the Home Expenses Category as they are related to household expenses.

Shopping Category includes clothes for you (and your family, if applicable), watches, jewelry, bags any fashion accessory is to be included here. Add categories to make it easier for you to understand if necessary.

Every category must include expenses in a separate sheet or column (if you use Excel).

This way when you want to look at expenses from a specific category say Shopping, you can see all things shopping and reduce/increase your spending depending on your financial conditions.

You can also make it more detailed by further categorizing your items in categories if necessary. For example – Under the Outside Food category, dining will be one item, you can further categorize it by the restaurant you dine in.

It does sound absurd but instead of dining in an expensive restaurant once a month, you could dine in a normal restaurant twice or thrice a month and still save money.

4. Allow Room for Flexibility

Maintaining discipline is the most important skill you need to restrict yourself from overspending. While you should at all times try to save as much as you can, don’t go too harsh on yourself.

The greater goal is to be consistent in budgeting. Staying frugal for 1 year is much more important than staying extremely frugal for 4 months or so. I recommend you keep a wiggle room of 5%.

Try not using up this 5% but if you end up using it then don’t be disheartened, as you are within your wiggle room and that’s absolutely okay!

5. Strategize Your Savings

What are you going to do with your savings? How are you going to utilize it so that you gain maximum benefits? Are you going to invest some money or save all the money?

If you want to be financially independent, only saving money won’t make you super-rich, it’s what you do after saving money that indicates what your financial position will be shortly.

Emergency Fund

You can’t call yourself a financially independent person if you don’t have an emergency fund. It’s a must and you need to make one. The thumb rule is to calculate your monthly expenses and multiply it by 6. Your emergency fund must contain 6 months of expenses.

After a or two years tries making it 8-10 months of expenses. I’ve written a detailed article on Emergency Funds and Why you have to make one, you can read and understand the importance of this.

Invest 30%

Once you’ve kept aside money for your emergency fund, out of the remaining money, at least 30% should go towards investments like stocks, bonds, debentures, gold, real estate, or whatever you prefer.

This is also a crucial step as your money needs to make more money. Choose an investment instrument you’re comfortable with and begin investing.

If you’re in your 30s, investing 60% of the remaining money is great. It all depends on the amount of risk you’re willing to take.

Save The Rest

Whatever remains should be saved. In case this money is idle, invest some amount in fixed deposit and recurring deposit which is the safest investment option out there.

You may get lower returns compared to stocks but better returns than a savings account.

6. Regularly Review and Adjust

After you do all these steps, Hurrah you’ve successfully tracked your expenses. But now’s the most important step of all – Reduce Expenses!

Once you have a systematic list of your net income and your net expenses, you need to start with each category and cross the expenses that seem irrelevant.

A cup of coffee a day from Starbucks, taking a cab to work instead of using public transportation, buying fashionable clothes (not for office), jewelry shopping, new electronics, burgers once a week, and so on.

Don’t eliminate all these expenses. If you have read my article on Needs vs Wants, you’ll know that spending 5% on wants is a must because it’s fun and we should all enjoy it, right?

If you haven’t read that article, I strongly advise you to give it a good read. You can use the 6-Step Method to track expenses for small businesses, it’s the same procedure.

Sage Tip: Make an additional category and name it Splurges. Distribute 5% of your net income strategically to maximize entertainment.

Bonus: Free Budgeting Template To Track Expenses

If a budget template is all you need to track your expenses effectively, look no more. I’ve made my Budgeting Template which you can use for FREE.

Here you will find multiple worksheets that you can fill. It includes Category-wise sheets.

One main sheet to include all your category expenses and A savings sheet to allocate your savings.

Read the details given in the Free Budget Template and then start tracking your expenses. I’m sure you’re going to love this Budget Tracker.

Tracking Your Monthly Expenses Effectively

As you watch your spending decrease and savings increase, you will be more motivated to cut costs to push your success. Use this motivation and save more.

You should take the time to reflect on your expenses at the end of each month. Your budget is your balance sheet and you need to keep checking it to improve your financial position.

If you feel that you can’t save anymore, try increasing your income either by taking on a part-time/weekend job or starting a side hustle. The higher your net income, the higher your savings provided you don’t increase your expenses.

Ultimately tracking your expenses is as easy as it can be, you only need to record your expenses each time you spend.

Then at the end of the month, scrutinize and find unnecessary expenses and ensure you don’t spend on that next month.

The key to getting awesome at tracking your expenses is being consistent and showing gradual improvements.

How do you keep track of your expenses every month? Do let us know in the comments!

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!