Debt Snowball or Debt Avalanche? Best Way To Pay Off Debt?

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

Knock knock.

Who’s there?

It’s your friendly neighbourhood Debt!

Okay, back to the serious stuff. When it comes to debt, we surely want to keep a distance from it but we always end up taking debt.

Why? because we spend on things we can’t afford to pay, maybe a car, a house, student loans or fashion accessories.

Though there are many ways to get rid of debt completely like staying hungry or walking instead of using a vehicle and practical ways like consolidating your debt or not consolidating your debt.

These are nothing but a few ways which may help us pay off our debt but will bring additional problems at a very hefty cost.

Having debt is a burden in itself, you can’t use tricks which don’t make sense or which create additional problems. You need a practical, realistic and easy approach to pay your debt.

So what’s the solution?

When you hear of debt, there are two methods to pay off the debt that come to your mind, they are Debt Avalanche and Debt Snowball.

Both of these strategies work well and can help you pay your debt and reduce your stress levels. Choosing any one of the two will help you ease your financial burden – Debt!.

So Which one to choose? And what’s the difference between the two?

Before we figure out which debt repayment method suits you, let’s understand what each one is and how it helps us to pay off debt.

What is Debt Avalanche?

The Debt avalanche method of paying debt says that initially, we need to make minimum payments to all our debts. Once we pay the minimum, the excess money left (income – expenses – minimum debt payments = excess money) will be used to pay the debt with the highest interest rate.

Why the highest interest rate? Because that’s where we lose most of our money – paying interest! If you use this method, you’ll save money as you will reduce the overall interest paid to the bank by aiming to get rid of that debt that has the highest interest rate.

What is Debt Snowball?

If Debt avalanche is so great, then why do many financial experts suggest Debt snowball?

The Debt Snowball method of paying debt also says that initially, we need to make minimum payments to all our debts. The excess money we have (income – expenses – minimum debt payments = excess money) will be used to get rid of the debt with the smallest debt amount.

Example – Kira has three debts – 20,000, 10,000, 30,000. If Kira uses the debt snowball method, she will try to pay off Rs 10,000 first followed by Rs 20,000 and then Rs 30,000.

Once we fully pay the smallest debt, we move on to the next smallest debt and continue paying the debt. The debt snowball is used to motivate us to continue paying debt and not give up.

Both the methods have the same basic principle, make minimum payments to all debts and the excess money you have, use it to pay off one specific debt, the only difference – debt snowball says to pay off the debt with the smallest debt amount first and debt avalanche says to pay off the debt with the highest interest rate.

One focuses on achieving small goals which will motivate us to make future debt payments and the other one takes a mathematical approach that ensures we save a few bucks through interest rates.

If you’re a person who is afraid of debt and sceptical about debt, choose the Debt snowball method.

If you think you can pay it off anyway and you want to save a bit of money too, choose the Debt Avalanche method.

Let me explain it to you with a simple example:

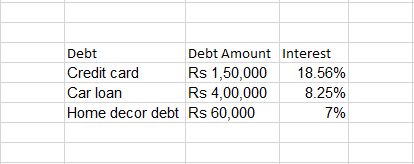

Varun has the following debts –

If Varun chooses debt avalanche, then after doing minimum payments to all his debts, he should try to put the excess money to pay the credit card, then a car loan and finally Home decor debt as it has the lowest interest rate.

If Varun uses the debt snowball method, he would first get rid of home decor debt, followed by credit card debt and finally the car loan.

What Dave Ramsey Says About Debt?

Dave Ramsey and his people love the Debt Snowball method and they aren’t wrong as to why they love snowball over avalanche.

Dave Ramsey says paying debt is 80% behaviour and 20% head knowledge. If that’s true then the Snowball approach seems to be the right one.

But what if you’re more inclined towards head knowledge? What if you like avalanche? If you like a method go for it. Both have their pros and cons and both are good in terms of debt repayments.

But if you’re still confused, this should clear your confusion.

When to Choose Debt Avalanche Over Debt Snowball

Debt avalanche uses maths to determine how to get rid of debt. If you’re that person who likes to rationalize everything and tries to save every penny without the need for motivation, Debt avalanche is the method. Grab it and run.

When to Choose Debt Snowball Over Debt Avalanche

You have to realize a fact – Owning debt makes a person feel bad, it causes many problems like depression, anxiety increases stress levels both in your personal and professional life. Debt Snowball is for those who need the extra push, and the motivation to pay off their debt as soon as they can and be debt-free.

Surely, a debt avalanche will save you some money but it won’t motivate you and give you the push you need in this critical situation. If you’re an emotional person and are afraid of debt, stop thinking and go for the debt snowball method.

That’s the right choice for you. Those few bucks you’ll save using the avalanche method won’t matter in the long run.

How to Free Up Money for Debt Repayment

If you want tips and tricks on how to save money, here are 23 practical ways you can easily save money.

But all these tips won’t be beneficial to every individual as your expenses might not be the same as my expenses or your neighbour’s expenses.

So what do you do?

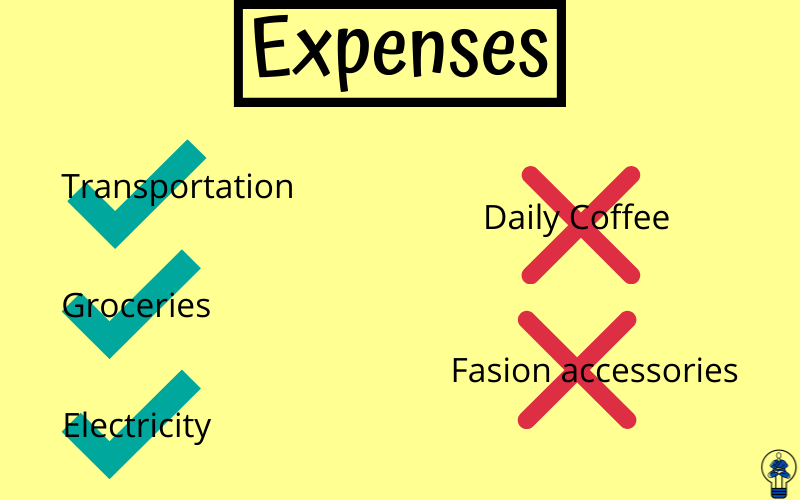

You create a Budget. A budget is a piece of paper where you write down your income after tax in one column, add any other sources of income. Then in another column, add all your expenses, be precise, including the smallest expense to the largest expense.

Once you do that you’ll know how much money you have left in your bank account. Now comes the difficult part, take a pen and slowly go through all of your expenses one by one, think about it, ask questions like is that expense necessary? Can I survive without this expense? If yes, then cross it off your expense list. Try your best to make as many crosses as you can.

Once you’re done, try your best to follow this new routine. Soon you’ll have a lot of money in your account which you can use for debt repayment. It’s not that difficult, trust me. A budget is all you need to get started.

You can create your budget, it’s simple – make two sides, one income and the other expenses and fill it up. Use colours to make it attractive. That way it won’t look dull and boring. If you don’t want to make one, you can use my Free Monthly Budget Template. Want to take budgeting to the next level? Try any budgeting app you know of and systematically track and record your expenses on the go.

Note: If you’re a beginner in budgeting, I recommend you either create a basic budget or download my Budget Template for FREE.

The Best Way to Eliminate Debt!

If the two above methods aren’t in your best interest, then the best way according to me for you is to forget everything and focus on the debt you hate the most!

In the above example, Varun hates his car loan the most as it’s a whopping Rs 4,00,000.

So once he makes minimum payments to all three, he focuses all his attention on paying as much as he can towards his car loan. Once he does that, now he will move on to the next debt he hates and then the final one.

Trust me Debt is not your best friend, the easiest way to eliminate it is either go with the two above strategies or to pick the one you hate the most, get rid of it, then pick the second most hated debt, finish it and repeat. That’s it.

Soon you’ll be debt-free and the excess money you now have can be used for entertainment and maintaining an emergency fund.

Don’t say you can’t maintain an emergency fund. You’ve seen what debt can do to you. That’s why you should always be prepared – create an emergency fund for the bad days and be financially secure.

How to get rid of debt?

Over the years there have been countless ways to eliminate debt and live debt-free. Obviously, there is no magic mantra to get rid of debt. At the end of the day, you HAVE TO pay off your debt. No shortcuts there.

But methods like Debt Avalanche and Debt Snowball or the one I’ve stated above will surely help you reach your goals with a little flexibility, logic and determination.

I hope by now you’ve decided on an approach to take towards your debt. Debt repayment is like a game. If you don’t know how to play the game, you won’t win. Similarly, if you’re not prepared to play, you don’t have a strategy to play the game, the odds of you winning are slim to none.

Don’t be a fool and think you can take on debt without a plan. Before you take a debt, have a plan, a foolproof plan towards repaying it, and then approach the bank or necessary authorities to take on debt.

Let me know in the comments below, what would you choose and why? Debt avalanche or Debt snowball? Down in the comment!

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!