Debt Consolidation – Your Instant Debt Free Path?

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

You’re in deep debt, credit cards, home loans, car loans, and on and on. You can’t handle so many debts and minimum payments for each are not working out either.

You’re scared that you might end up being broke on the street, with no money and a huge debt on your shoulders. Right when you see a video on YouTube talking about a secret passage to be debt-free – Debt Consolidation!

Here are my two cents on this: Debt Consolidation isn’t all that bright, run away from it or it may lure you in.

If you want to know more about debt consolidation and why it’s not all that bright, continue reading as I explain everything you need to know about consolidating your debt.

What is Debt Consolidation?

Debt consolidation combines multiple debts into one. So instead of making multiple different payments each month, you make a single payment that includes all of your debts.

By Consolidating, you are charged less interest and your monthly instalment also drops, thus making it easier for you to pay your loan.

But is it a viable option? Should you consolidate your debt? Will debt consolidation get you debt-free much faster than the speed of light? Let’s find out!

Debt Consolidation doesn’t mean Debt Elimination

Many people think that by consolidating their debt, they’re instantly debt-free. They can relax and not stress too much about their loans. No that’s not the reality.

Yes, multiple loans merged into one along with lower interest rates might sound exciting, after all, a lower monthly payment means you have more flexibility to spend on other things but the duration of the loan is longer than before.

This means that in the long run, you end up paying a lot in interest which is completely unnecessary.

Let’s take a practical example to understand this better.

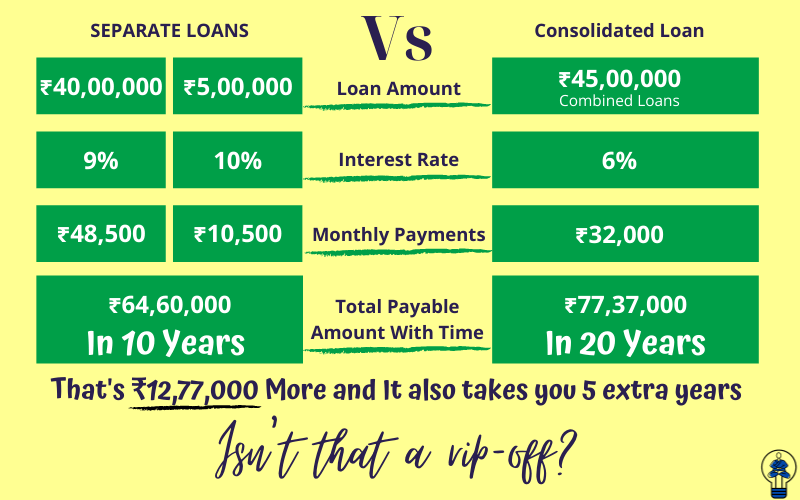

Peter has two loans, a Car loan of Rs 5,00,000 at 10% interest and a Home loan of Rs 40,00,000 at a 9% interest rate.

On the home loan, his monthly payment is Rs 48,500 for 10 years. The total interest payable is Rs 18,23,000.

On the car loan, his monthly payment is Rs 10,500 for 5 years. The total interest payable is Rs 1,37,000.

Total Monthly payment sums up to Rs 59,000. The total loan amount will be completed in 10 years. The total interest paid for the loans is Rs 18,23,000 + 1,37,000 = Rs 19,60,000.

If Peter goes to a debt consolidation company and Consolidates his debt, the new structure and his monthly payments will be,

The loan amount will be 45,00,000 at a 6% interest rate (lower interest rate offered) and monthly payments will be only Rs 32,000 for 20 years.

Who wouldn’t like to pay less for the loan they took? But here’s the downside – Total interest paid to the debt consolidation company is Rs 32,37,000.

I hope you understand the situation now.

If you consolidate your debt, it will lower your monthly payments but you will be paying a whopping Rs 12,77,000 in interest to the company offering this service. That’s a lot of money and you spend an additional 10 years in the debt path.

A lower interest rate can surely be amazing but if you sit back and do the math, you’ll understand that these companies are doing their best to make you pay much more. In the long run, you’ve wasted a lot of money.

Could you Negotiate a shorter duration from your Debt Consolidation Company?

In most cases, it won’t be possible as the main purpose of such companies is to reduce your overall monthly debt payments and extend the time frame.

This way charging you more than you were supposed to pay. If you have a total of Rs 6,00,000 in debt, you have to pay this amount whatsoever, Consolidation companies won’t give you a discount and say that you can pay Rs 5,00,000 and interest and you’re debt-free. Not even banks will ever do that.

Remember one point – If you have taken debt, you have to pay it, there’s no other option, no easy way out of debt.

When should you consider Debt Consolidation?

Trying to avoid this is the best thing to do. But if you really can’t pay that much amount upfront each month and even an additional source of income doesn’t do the deal, you may consider approaching a company that offers this service.

Only when you need it, use it. Otherwise, forget it altogether. You are better off thinking about how to increase your monthly payments so that you can pay off your loan earlier than the period.

Companies aren’t Cheating on you

Many people who hate debt consolidation think that companies that offer such services are looting the public for money. They are taking advantage of a situation and are greedy.

That isn’t correct and here’s why – they are a company, they have employees that need to be paid salaries.

They are offering the person with debt to be less stressed about debt by reducing the monthly installments and charging their fee for the comfort they provide, what’s wrong with that?

Change your Habits Not your Interest Amount

Most often, after someone consolidates their debt, they fall right back into the same trap they were in before they did consolidation.

The reason behind it isn’t that their loan amount is huge or they’re so stressed. It’s because of the bad money habits they stick close to.

No matter what you do to ease your life from debt, if you have bad spending habits i.e you don’t know how to save money, you spend aimlessly, you don’t invest a small part of your money, you don’t have an emergency fund, you don’t have a budget that tells you how much you spend every month, don’t expect your debt to get paid in full ever.

You’ll always remain in debt and miss almost all payments. Before you take on debt, learn Personal Finance, understand money and what money does, and how you can use the money to make, save, and invest it wisely.

Do you jump into a deep pool if you don’t know how to swim? No right!

Similarly, learn the basics before you take on any debt.

Your Best Alternative To Get Rid Of Debt

Be it debt consolidation or some other fancy method, in the end, you HAVE to pay your debt amount completely. There are no shortcuts to paying off your loan amount.

But here’s something you can do to Eliminate debt. The two best strategies to Eliminate debt are Debt Snowball and Dent Avalanche.

The Debt Snowball Method says that you should pay off the debt with the smallest amount first, then move to the next smallest amount till you get rid of the debt.

Tackling the small debt amounts first will give you a boost of confidence and will motivate you to make consistent payments moving forward.

The Debt Avalanche Method says that you should tackle the debt with the highest interest rate first. Once that is paid, move to the second-highest interest rate debt till you finish paying all.

The logic is simple; the debt with the highest interest is the most expensive so paying that first will lower your overall interest amount thus benefiting you in monetary terms.

Both of these methods are extremely effective and practical. If you want to know more about Debt Snowball and Debt Avalanche Method, I’ve written an article on Debt Avalanche and Debt Snowball explaining the two in detail.

Should I Consider Consolidating My Debt?

Most people shouldn’t even opt for this. Debt consolidation is made for those who have extremely little money and can’t make regular payments. For the rest: No thanks, you are better off without it.

The goal is to get out of debt fast, not stay in debt FOREVER. So unless you’re extremely tight on your budget and may not be able to pay your bills due to various loans, you can consider consolidating your debt by approaching a trusted company that will offer the service.

But remember to calculate how much period it is for and how much interest is the company charging you.

If it seems too much, you might as well step back and work on paying your debt quickly the normal way and use Debt Avalanche or Debt Snowball, or a combination of the two to accelerate your Journey to Debt Free.

Your decision to take on that much debt was wrong, but now that you’ve done it, don’t be sad about it! Instead, change your view towards debt and think about how you can get rid of debt as soon as possible.

That will be in the best interest of all parties, maybe not your loan-providing bank 🙂

Start today, make a plan, and work hard till you get rid of debt. I know you can do it!

What are your honest opinions about Debt Consolidation? Share your opinions in the comments.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!