Is 50/30/20 Budget Rule The Best Way To Budget?

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

No matter if you’re a fresher or a 35-year-old mom with two kids or a wealthy businessman, this rule can easily help you untangle your life by figuring out how much you should be spending on your needs and wants each month.

When it comes to spending money, there are infinite ways we could spend it.

But every time you try to think of something like that, your family or online financial experts tell you to stay away from overspending and start making a monthly budget.

What I like about the 50/30/20 rule is that it is so easy to do and you don’t even need any skill to budget using the 50/30/20 rule.

But before we hop into the most favorable type of budgeting, let’s understand budgeting a little.

If you want to skip through the need for budgeting, click here – 50/30/20 budgeting rule.

What is Budgeting?

Budgeting is a financial plan created to help you control your money. Creating a budget plan allows you to plan the things you need and want. Doing this will ensure you have minimum expected expenses a.k.a pre-planned purchases.

It’s simply balancing your expenses with your income and ensuring you don’t overspend using a credit card or other forms of debt.

A good budget means you have low expenses, enough savings after investments, retirement funds and emergency funds accounts.

But why don’t most people stick to a budget?

It’s hard to digest the fact that budgeting is “HARD”, especially when you do budget regularly. To be a successful saver, you need to budget your expenses. It doesn’t get any easier than that.

But for those who believe budgeting is hard, if you know the basics of how to work a budget, Trust me – It Is Easy! Really Easy…Easy Peasy!

Anyway, let’s forget about budgeting and all the things that make you believe it’s hard and read the article, alright? By the end of the article, I am certain of the fact that budgeting will be a new normal in your life. Now let’s discuss how to make a super interesting budget in the simplest way humanly possible.

Benefits of Maintaining a Budget

- Creates Discipline

- Keeps a check on expenses

- Inculcates Habit of Saving

- Makes you an organized person

- Ensures you achieve your financial goals

Although there are many ways you can budget your expenses, the most well-known budgeting strategy is the 50-30-30 budgeting rule.

Senator Elizabeth Warren is named by Time magazine as one of the 100 most influential people in the world and a Harvard bankruptcy expert coined the “50/20/30 rule”.

So how does this Budgeting method help us? Here’s how Warren recommends you should organize your budget.

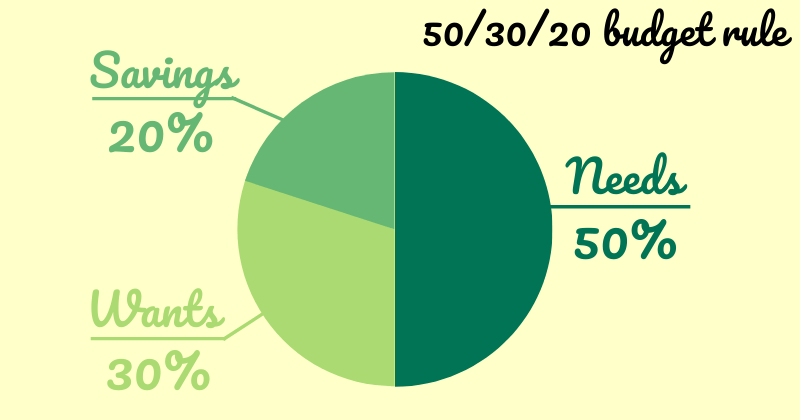

What is the 50/30/20 Budgeting Rule?

The most common and used budgeting principle out there is the 50-30-20 principle of budgeting. Let’s try and understand this budgeting rule so that you can start adopting this rule in your financial life.

Simple Steps to Implement the 50/30/20 Rule

Step 1: Calculate your after-tax income

The first step towards creating any type of budget is calculating your income (not gross income but net income). Net income is the income that you receive after the government cuts taxes.

If you’re an employee, your after-tax income will directly reflect in your bank account. If you’re self-employed, minus your business expenses from your gross income to get your after-tax income (net income).

Write down this number in your Budget Worksheet or a piece of paper. Once you have this number, move to the next step.

Step 2: Pen Down All Your Expenses

Your next work has to be to calculate the approximate cost you spend each month. If you don’t know this number, start writing down all your day to day expenses like rent, grocery, transportation, clothes and so on.

Categorize these expenses into needs and wants. This is your expense sheet. Anytime you feel like making changes in it, you do it here. Want to spend some more this month on movies?

Reduce your expenses somewhere and with the additional money now available, watch your movie. Let’s say you reduce your transportation expenses for 5 days. The money accumulated can be used for your movie day. Simple?……Great!

Step 3: Distribute Your Expenses In A 50-30-20 Ratio

50% – NEEDS

The first 50% goes to your needs. Your needs are those expenses which are super essential for your living. Without these expenses, you can’t live. You have to spend money on such expenses as they can’t be ignored.

50% goes towards necessities like

- Clothing

- Groceries

- Housing

- Basic Utilities

- Medication

- Transportation

- Insurance

This money is also used to pay off debt and loans (eg – housing and car loans) and other essential expenses incurred.

Note: Many people confuse Needs with Wants. While preparing your budget, be clear on what’s a need and what’s a want. Distinguishing these two terms will reduce your budget-creating-difficulty level from a 7.5 to a 3.3!

30% – WANTS

The next 30% is for your luxuries and lifestyle choices. These are your Wants.

The idea is to spend less than or equal to 30% of take-home income. These include items or experiences which bring some relaxation and entertainment to your life.

Every person must spend some money on fun stuff, maybe that’s a movie or dinner or spending money on art or a fun day at a theme park.

By allocating 30% or less towards wants, you’re allowing yourself to happily spend that much cash on a product or an experience and still not worry about your budget.

Wants may include:

- Vacations

- Gym memberships

- Spa & sauna treatments

- Netflix & Amazon prime subscriptions

- Parties

- Food joints

- A new Phone

- Movie Tickets

I’ve seen many people forcing themselves to spend 30% of their income on wants. They believe that the only way they are happy while budgeting is spending on wants. Don’t spend just because the rule says it.

If you spend less than 30%, that’s even better, save and invest the remaining. The basic thumb rule is anything you crave should fit in the 30% budget category and not exceed it. So don’t exceed it!

20% – SAVINGS

The last 20% goes towards investments and savings. Whatever you save after all your expenses should be saved and invested properly. Open a savings account and keep some cash there, the rest invest it in stocks, gold, real estate, bonds, forex and other such investments.

If you’re new to investing, you might benefit from my article on How To Invest With Little Money.

Here are some great ways to invest your 20%

- Investing in SIP through Mutual Funds.

- Buying Stocks

- Invest in Fixed Deposits/Recurring Deposit a/c

- Buying Bonds

- Emergency Fund

- Retirement Account

While you only have 20% for savings, I suggest trying to squeeze in more towards savings by reducing your expenses. The more money in your bank, the faster you achieve financial freedom.

Sage Tip: Part of this money should be used for creating an Emergency Fund for unforeseen expenses.

Remember having an emergency fund for your future needs is non-negotiable. If you don’t have enough to start an emergency fund, cut down your expenses, and start one right away.

The 50/30/20 Rule Net or Gross (After Taxes or Before Taxes)?

The 50/30/20 Budget Rule is only taken on Net-income i.e After-Tax income.

The strategy focuses on budgeting the remaining amount after you pay taxes, your 401(k) contributions or any such payments that are made before your income touches your bank account.

Calculating the budget after paying taxes is much easier as you don’t need to make tedious calculations.

50/30/20 Budget Calculator: Let’s Calculate

Calculating 50%, 30% and 20% is easy, even if you are not a math nerd, I’m sure you can do it! I’ll walk you through the calculations step-by-step, don’t worry.

Percentages (like 10% or 20%) are nothing but a fraction. Now a fraction is a number divided by another number, for example – 5/10 or 3/6. Now percentages are a part of a whole (in maths, 100 represents a whole), it’s like a small piece of a pie.

The larger the piece, the greater the percentage value. So 10 per cent (10%) is 10/100 which is 0.10 (0.10 is the same as 10%, it’s written in decimal form to make calculations easier).

Once you have converted the necessary percentages into decimal form, simply multiply them with your net income and voila, your budget is ready. Now you know how much you can save each month and how much you can allocate for your needs and wants.

If your monthly net income is $3000, then –

$3000 x 0.20 = $600

$3000 x 0.30 = $900

$3000 x 0.50 = $1500

Easy? I tried to make it as easy as possible 🙂

If you’re wondering, Rylan, where is the calculator, I don’t like to Manually Calculate!!! I would have used a calculator but the math here is too easy, I don’t think you need a calculator. Practice doing it without one, in no time you will be able to mentally calculate all the numbers.

50/30/20 Budgeting Example

Let’s take an example, Amir makes $3000 a month (net income), that’s $36,000 a year. That means he should spend nothing more than 50% of $36,000 on Needs i.e. $18,000. Further, he can spend 30% of his income which is $10,800 on Wants and the rest $7,200 should be saved and invested.

Again, Amir’s goal shouldn’t be to save only 20% of his income. If he can, he must try to save more. The 50/30/20 rule acts as a benchmark to manage your finances. Maybe Amir’s expenses (needs) are far greater than 50%, in such cases, he has no choice but to allocate more towards his needs, which is possible by cutting down on wants and reducing your savings.

The best way to do that is to increase your income by starting a side hustle or doing a part-time job. The additional income will help Amir, save more and his financial situation will get better.

Free 50/30/20 Budget Template

If you have been waiting for a budget template that follows the 50/30/20 rule, wait no more. Here is your FREE 50/30/20 Budget Planner that you can print out each month, fill it, and start saving.

I have left a blank space above the word – -budget template (___/___/___), you can write your percentages. If 50/30/20 is not possible write percentages that work best for you. That can be 70/20/10, 80/10/10, 40/30/20, etc. There is also a third column called ‘Work’ Here you can do basic calculations for each expense if needed.

Pros and Cons Of The 50/30/20 Rule

Pros:

- Works great if you are a beginner

Maths is tough but doing 50 X (your income) divided by 100, isn’t rocket science. Like I said before, Elizabeth Warren made this rule so that any beginner could start budgeting today and not get exhausted by the process.

- Teaches you the importance of budgeting

There’s a reason why following a good budgeting plan is crucial. Financial Experts love budgets because they know their students have had massive results by following such a plan.

- It’s Simple

I doubt budgeting could ever get any simpler than this. Take your expenses and divide them into three segments (50-30-20), et voila your budget template is ready.

- Better than not having a plan for your money

Something is better than nothing, right! It’s better to know what you are spending your money on rather than spending it without being aware of the money you spend.

Cons:

- Spending 30% on wants and 50% on needs seems a little too much

This budget aims at being a balanced budget for a balanced life which usually takes a few years to get adapted to. 30% of wants is a lot! You don’t need to spend so much at all.

Anything between 10 – 15% is good enough. The same goes for needs, I’ve seen people adapt to 90/10 which is 90% to savings and investment and 10% for wants and needs.

You don’t need to be so aggressive but following the 70/30 budgeting rule is a good option – 70% towards saving and investment while 30% on needs and wants.

- You get too addicted to hitting the percentages

Just because it says that you must allocate 50% to needs, doesn’t mean you must. Your needs aren’t the same as your colleague’s needs. We all have different needs, wants and incomes.

The primary purpose of the 50/30/20 rule of budgeting is to make sure you don’t exceed your needs by 50%, you don’t exceed your wants by 30% and you do increase your savings by 20%.

Why do we buy unnecessary items?

We believe that buying more items leads to a luxurious life filled with happiness. When we buy some item, we get instant gratification from it which makes us happy and satisfied.

We believe that if we repeatedly buy things and get this short-term happiness, we can be happy and live a contented life for a long time.

We see our peers make lavish purchases and follow the same. We end up buying things we don’t need or use.

We spend money we don’t have, and take loans we can’t repay on time. This needs to stop. You can’t spend money under the influence of your friends.

To ensure you don’t spend on irrelevant items, you should know the difference between needs and wants, once you understand the difference, you will be able to track your expenses and ensure you don’t spend on things you don’t really need.

Do These Budgets Have A Scientific Logic?

The budgeting tactics discussed here are just assumptions based on logic and data. What is the 70 20 10 Rule money? It’s spending 70%, saving 20%, and donating 10%.

If you google a bit more about the 50/30/20 budgeting rule, you’ll also find various percentages, but they all boil down to these three rules of money:

- Save more & spend less

- Plan for your future

- Invest your money and let it grow

Can you spend 40% on needs and 10% on wants and save 50%?

Of course, you can. What if your expenses are over 80%? In that case, you need to check your budget properly, find errors that can easily reduce your expenses, and then redirect that to paying 80% of your expenses.

In most cases you should be able to cut off at least 10% of your expenses, I would recommend you spend very little money on wants if your needs exceed 70% of your net income (10% on wants is enough).

You can change your budget according to your convenience and comfort. Keep in mind to try your best to cut off expenses to save money.

I’ve seen people following the 40-30-20 budget, 40 – needs, 30 – wants 20 – savings. I have also seen many individuals following the 90-10 rule of Budget means 90% for savings and investments and 10% towards expenses and debt. They do live a happy life in case you are wondering and yes they know the difference between needs and wants. This helps them to make their decision easily.

If you are new to budgeting, I suggest you write down all your expenses in a traditional format i.e. jotting down every expense in a linear format.

Then cancel all the irrelevant expenses and calculate your savings. Put a part of your savings aside in another account for emergencies – This is your emergency fund account.

Then keep some money in your savings account for everyday purposes. The remaining money should be invested in a medium to low-risk investment fund where your money will make more money using the power of compounding.

Investing your money and enjoying the power of compounding is simply just AWESOME! Although saving each month might seem impossible at first, regularly checking your Budget sheet to scrap out any sort of unnecessary expense will help you save more over time.

The Max Spend Line

Humans (including me) tend to spend money every day, these expenses aren’t huge expenditures but minor expenses like eating a sandwich.

I’m not suggesting you should avoid such expenses but what you should do is limit your expenses to a certain amount. You won’t exceed this amount whatsoever. Within this amount, you’re allowed to spend on whatever it is that you eagerly desire.

I like to call this line “The Max Spend LIne” which is simply an amount over which you cannot, I repeat CANNOT spend on a given day. For instance, after calculating your income in a given month, divide your average expenses by 30 days.

Let’s say your Max Spend Line is 100 per day, which basically means that you shouldn’t spend any more than 80 a day, and if you spend less, that’s simply icing on the cake.

What happens to the remaining Rs 20, that’s additional savings you need to save in your piggy bank.

Assuming on day 18, an unforeseen event takes place resulting in an increase in your daily budget to 250. In such circumstances, you’re likely to break your emergency fund and withdraw cash. But because you have saved some money each day – 340 (20 x 17 days), you don’t need to break your savings or emergency fund.

How Can You Save Money On A Low-Income Fast

Be Disciplined! What else did you expect me to say? There is no secret mantra to save money. Using the 50/30/20 budgeting rule will help you but it boils down to being disciplined with money.

The true test lies when you observe your daily life carefully, I’m talking about being aware of what financial activities you do on a daily, weekly, and monthly basis.

In some time you will start seeing buying patterns around you; how companies lure people into impulsive buying. Once you are at this stage, congratulations! You won’t indulge in buying (at least you’ll reduce buying!) because now you know the trap and can easily avoid it.

Is Saving 20% Of Yearly Income Enough?

If you have a bunch of expenses, saving 20% of your income is enough. But if you don’t have that many expenses and if you want to push yourself a little harder, that’s great! If you are young, it’s best if you live frugally, and save as much as you can for your future.

So yeah if you can, do save more. But don’t forget to invest the saved money in these 4 things before saving it in a bank account –

- Emergency Fund

- Debt Payments

- Retirement Account

- Investments (stocks, real estate, etc)

Note: Usually high-income earners can easily save 60 or 80% of their income, that’s a lot of savings. Try increasing your income while keeping your expenses the same or lower than before and I’m sure you will easily retire much earlier than you expected.

Is the 50/30/20 Rule Still Realistic These Days?

The 50/30/20 Budget Rule is going to be applicable forever. This rule was created to create a budget that is easy to understand, quick to prepare, and enough to enjoy (wants). I don’t see any reason why the 50/30/20 rule will go out of fashion.

I am saying it again, these percentages are just estimates. You need to see your lifestyle and adjust your budget accordingly. Maybe 50/30/20 isn’t working for you, no problem, tweak it to your requirements.

Live Below Your Means

I get it, your friends have amazing cars or expensive watches that you were longing to buy but don’t get tempted. Before making any purchase, First think – Is it a Want or a Need?

If it’s a want then take a deep breath in and let go.

If it’s a need then make a purchase.

Don’t be that person who spends money as and when he gets it. As a human, your responsibility is to not only think of the present but also the future.

So are you ready to follow the 50/3/20 Budget Rule? If you have any questions, let me know in the comments below.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!