Robert Kiyosaki’s 10 Rules For Success And Wealth

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

Do you always find yourself out of money? Do you accumulate assets or liabilities? Did anyone ever teach you finance as a subject in school or in real life?

Most of you will ignore the above questions because you’re likely a victim of these financial burdens.

Today is the day you take a leap of faith to start learning about finance from the best – Not me, I am talking about Robert Kiyosaki.

Who Is Robert Kiyosaki?

Robert Kiyosaki is the author of one of the best financial books in the world – Rich Dad Poor Dad. This book has definitely changed the mind of millions of people all over the world. I know it has certainly changed mine.

Rich Dad Poor Dad has sold over 32 million copies in more than 109 countries and has been on the New York Times Bestsellers List for over six years.

Robert Kiyosaki has taught a lot of millennials what money is and the difference between an asset and a liability. You don’t know the difference? Read the book. Trust me you won’t regret reading this book.

Without wasting any time, let’s dive into Robert Kiyosaki’s 9 Rules For Success And Wealth.

1. Change the way you think

This is the first step towards amassing riches. Robert Kiyosaki makes it very clear that what separates the rich from the poor is their mentality, the way they think and perceive a situation. A poor man usually says, ” I can’t afford to buy the car” whereas the rich man says, ” How can I afford to buy this car?”

This mentality forces the mind to think of new and innovative ways of making money to buy the desired car. A question opens your mind to new possibilities while a firm statement closes your mind. You need to start unlearning everything you know about money and start learning the real way money works.

You might think entrepreneurs are rich and make money from the get-go but most entrepreneurs work for free for a long time till they make pennies.

So you should work for free? No, you need to learn to make money without any money and you can achieve that by changing the way you think.

2. Financial education

Unfortunately, our school does not teach us financial education. In schools, we learn that money is the root of all evil but in the real world, we need to know our finances very well, if we don’t, we end up being broke or in depression.

Yes, a lot of people are depressed not because they have a lot of money, it’s because they don’t know how to manage their money.

Financial education helps us manage our money and create new passive flows of income for our future needs and wants.

Related: 45 Personal Finance Tips For Your Financial Well-Being

Robert Kiyosaki says that the gap between the rich and the poor increases only because the poor don’t know how to manage money whereas the rich manage their money extremely well.

And the middle class? They try to spend a lot and show off being rich, by doing this they are getting poorer and poorer.

What you do in your 20s sets you up for life. That’s why learning financial education in your 20s is the number one thing you should focus on.

There are so many online courses on financial education, choose a course, and start today to stay ahead in the journey to financial freedom.

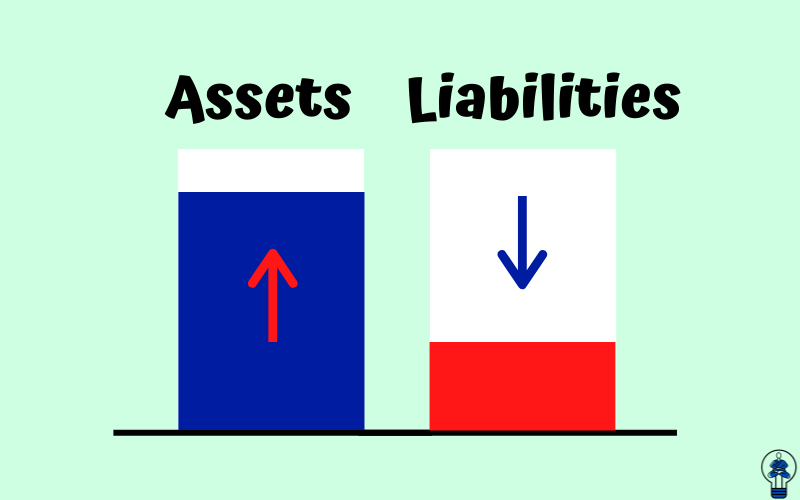

3. Focus on acquiring Assets

Rich Dad Poor Dad spends a lot of time discussing assets and liabilities. About how the rich acquire assets and the poor acquire liabilities they think are assets. To acquire an asset, you first need to know what an asset is, what it does.

An asset is anything that puts money in your pocket.

A liability is anything that takes money out of your pocket.

If you understand these two statements properly, you’ve successfully understood 40% of how the rich get rich. Learn about how to acquire assets and make goals to achieve those assets.

At the same time, make sure you don’t acquire liabilities you think are assets because liabilities will suck all of your money and be a financial burden for you.

For example, many people think their house is an asset but in reality, it’s a liability. Your house doesn’t pay you anything because you stay in it, it only takes money from you in the form of loans, maintenance, interior work, etc.

Once you have a few assets, these assets will make money in itself while you relax and not worry about money.

4. The more you give the more you receive

To make money you need to give money. Robert Kiyosaki says that a lot of people want to accumulate money but if they can’t give something in return they won’t receive anything. If you want to earn more, work more than you usually work and soon you will earn more.

Even if you have a little, give a part of that to charity, maybe provide lunch to a beggar or visit an NGO and provide them with the things they need.

If you give your something to someone today, someone will give you something tomorrow. But don’t expect something in return while doing a good cause. Just Give, Give, Give, Don’t expect.

5. Take risks

Robert Kiyosaki says, “If you play it safe, that makes you stupid, if you don’t take risks, you won’t get smarter”. He took a lot of risks when it came to business and always grabbed opportunities that knocked on his doors.

Don’t just take any risks, you need to take calculated risks. Take smart calculated risks not dumb foolish risks

If you don’t take a few risks now, you’ll wait your entire life hoping for a miracle to set you free from your financial burdens.

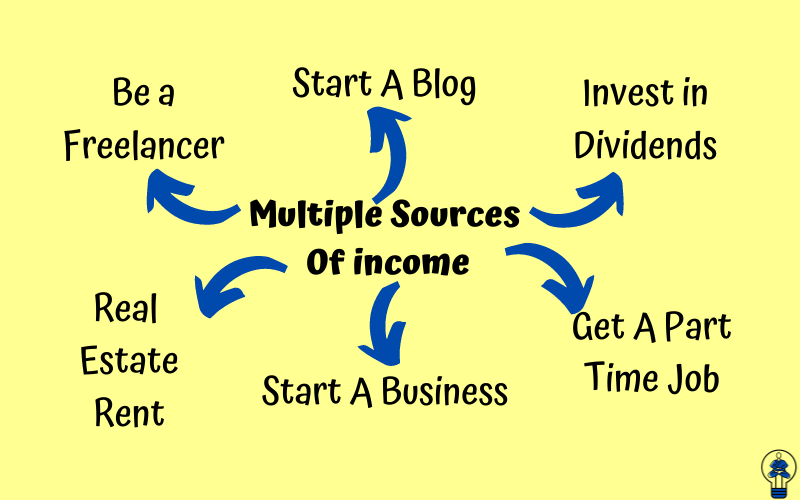

6. Have multiple sources of income

If you only rely on your job for income, the possibility of you achieving your dreams and financial security is negligible.

My economics professor once said, “If you have a single source of income, you are committing a crime”. It sounds a bit crazy but he is right on point.

At the end of the month, if you have money pouring in from just one account, you need to seriously think about how you’re going to hit your goals and accomplish financial freedom.

Why you ask?

What if you get laid off from work? Your only source of income just vanished. What do you do now?

Till you search for another job, you need the money and that’s why having another source of income helps you pour in money even when you’re fired from work.

I suggest you have at least 2-3 income sources every month. Start a business or become a freelancer or invest in stocks, bonds, or real estate (only if you know to make money from real estate).

Start small but start today and grow your secondary income to an extent that it replaces your primary income(your job).

In time you will acquire assets and your income streams will flourish. Now you are on the path to financial security.

7. Fail Faster

Schools tell us that you never make mistakes and only fools make mistakes.

Then why does Robert Kiyosaki want us to fail?

Every person, be it an entrepreneur or an employee fails at something every day, what he’s saying is Fail Faster.

Let’s take an example – The main work of a scientist is to experiment, which includes trial and error. When they make mistakes, they learn from it and try another approach.

They don’t stop no matter how many times the experiment fails. Scientists teach us that The more you fail, the more you learn from your mistakes and the better you become over time.

That’s why failing is an essential part of success and by failing faster you don’t waste too much time grieving about failure and try your best to reduce your risk.

Poor people need to understand that making mistakes is not stupid, it’s only stupid if you don’t learn from it and make the same mistakes again and again.

Mistakes are nothing but opportunities that make us stronger and smarter and put us on the path to success.

Related: 15 Things Highly Successful People Do In Their 20s

8. Know the difference between good and bad debts

Here’s where a lot of people get confused. They think debt won’t affect them at all. In reality, debt is very difficult to handle and can make or break your financial success. There are two types of debt – Good Debt and Bad Debt.

Good debt is something that helps you grow your income in some specific way, your income may not increase right away but should increase in the near future.

Bad debt is something that satisfies your “Wants” and which will certainly not make you any money in the short run or the long run. Bad debt steals your money just like a liability.

Good debt can be a loan for your business or for incurring a new asset.

Bad debt can be purchasing electronics or new furniture which leads to overspending using your credit card or wasting money borrowed from the bank.

Spending on wants isn’t necessary but gives you temporary happiness which makes you think that the debt incurred was good.

The simple rule, stay at least 10 feet away from bad debts and stick close to good debts as they make you rich in the long run.

Related: How To Improve Your Credit Score: 7 Easy Tips

9. Don’t run the race alone

You started a business you wanted to, but you can’t seem to grow it to a point to make you a lot of money!

That’s because you’re not an entrepreneur, you’re a solopreneur. A Solo-preneur is someone who runs the entire business alone without any help whatsoever, somewhat like a self-employed person.

An entrepreneur knows that having a lot of hands will only help him grow his business, unlike a solopreneur who likes to work alone because he or she doesn’t want to share his income or because he or she doesn’t know how to work as a team.

Growth happens when you grow your business which isn’t possible being solo.

10. Don’t wait for opportunities, just create one

Most of us wait for the perfect opportunity to knock at our doors.

We want an opportunity to be offered a promotion at our job

We want an opportunity to earn more money.

You might think, if only David chose me to invest in an asset, I would make money with him.

You’ve got to stop thinking and start creating opportunities for yourself. Don’t wait for a promotion, work super long hours, and come up with new effective strategies. Let your work speak for yourself.

Just create an opportunity, don’t waste time hoping for something to happen.

Why the middle class suffers?

The middle class constantly finds themselves in financial struggles. That’s because their source of income is their salary and as they get promotion and salary increases so does their liabilities and expenses.

But if every time their salary increases, they find ways to buy assets that generate income, soon they will get out of the rat race and achieve financial freedom.

If you want to be rich, you have to change the way you look at money and figure out new ways to earn money.

The Bottom Line

If you’re a Millennial and you don’t know anything about money, or you can’t figure out a way to increase your income streams, I suggest you read this book.

Don’t just read it, understand what the book is trying to teach you, and implement its principles.

Don’t be a miser just because you want to earn money. In a business, pay everyone what they deserve. If you pay them less, they will get demotivated to work for you and your business will fall.

Getting rich isn’t an easy path. It starts with the right financial education and Robert Kiyosaki has explained to us about money in layman’s terms in his book Rich Dad Poor Dad.

Don’t get stuck in the rat race, it will just pull you down and create new financial problems.

Learn how money is created and how it travels from one person to another so you never have to worry about money ever again.

What’s the biggest success rule you think will take you on the path to financial success? Let me know in the comments below.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!

Great understanding about money..ive learn a lot.ty😋

You’re Welcome Robert 🙂 I’m glad this article helped you understand money. Have a great day!

You really understood Robert’s book quiet well. I like the way you write!

Thank you so much! Glad you liked it.