Rent Or Buy A House? Let’s Settle The Debate

This article may contain affiliate links. If you make a purchase using my links, I’ll earn a small commission at no extra cost to you. I appreciate your support!

The ongoing debate of whether to buy or rent a house probably might never get over.

While owning a home is the dream of every Indian family, along with the dream comes a financial burden.

No, I’m not saying that buying a house is bad, it’s bad if your math says it’s bad.

Hear me out. 30 years ago the prices for housing were realistic, affordable, and definitely not overpriced.

But the situation has changed today. Housing in India has become extremely expensive.

Real estate prices in cities like Mumbai will not decrease anytime soon and it certainly isn’t wise to make a decision just on the basis of feelings and emotions, that’s why you need to ensure that the decision your take is the right one.

Key Factors to help you decide whether you should Rent or Buy a House.

1. Financial Readiness

You need to ask yourself a few questions, how is your financial situation? Do you have enough money to buy the house in cash or on a mortgage basis? If you mortgage your house, do you have enough money for the mortgage down payment and your family?

Are you ready to stay in debt for a decade or two? Asking such questions clarify your doubts on whether you want to buy or own a house.

If you have the means, you should definitely buy a house because it gives you a feeling of satisfaction and joy.

2. Personal Readiness

Do you want to buy or rent a house? Some people like to stay on rent not because it’s cheaper but because they like shifting houses or they don’t like to own a house.

Whereas some people want a house because they have never stayed on rent. You need to choose what you think about renting and buying a house and then decide if you’re willing to buy or rent a house.

3. Location

Location is very important when it comes to real estate property. A lot of people prefer renting because it gives them an option to shift to the location they would want to live in.

If a location they currently live in isn’t that good for some reason, they can always move to another property.

But in case of buying a house, this isn’t possible because there is a huge investment and your money is fixed in an asset.

You need to ask yourself, do you like to move from apartment to apartment or do you like to stay in one apartment for at least a few years.

4. Your Lifestyle

A key factor in deciding whether to rent or to buy is a lifestyle. How is your lifestyle? Are you a spender or a saver? If you’re a spender and you buy a house on mortgage, you might have a very difficult time as you won’t have too much money to buy luxurious items most of the time.

Maybe your work demands you to spend money on food and clothes and fancy parties, in such cases buying a house isn’t the right option. If you’re a saver and you buy a house, that will be a better decision for your finances.

5. Your Financial Goals

Keep in mind that if you purchase a home, you bring a whole new set of expenses with it like taxes, maintenance, insurance, and repairs. You will be restricted to spend a lot of money and thus your luxuries might have to slow down.

If your financial goals include other expensive items like cars, you might have to recheck your budget as you won’t have enough to buy other items.

Let’s take a look at the advantages of Renting a house Vs Buying a House

Advantages of Renting Over Buying

- You can rent a house near your workplace or your child’s school

- You will pay less if you rent. For a property worth Rs 1 crore, your monthly rent should be 20,000 whereas if you buy it, you will have to shed 60,000-80,000 per month as EMI (Equated Monthly Installments).

- You can always shift your location if there’s a problem with the current locality easily.

- There will be no debt on your shoulders

- As renting is cheaper, you can spend excess money on vacations and luxuries.

Advantages of Buying Over Renting

- You can do whatever you want in your house, cause it’s yours.

- There is emotional security attached to the House.

- You get tax benefits on home loans

- Mortgage costs don’t increase every year like rent prices.

Let’s take some examples to understand the problems with renting and buying a property.

Rent Or Buy Example 1

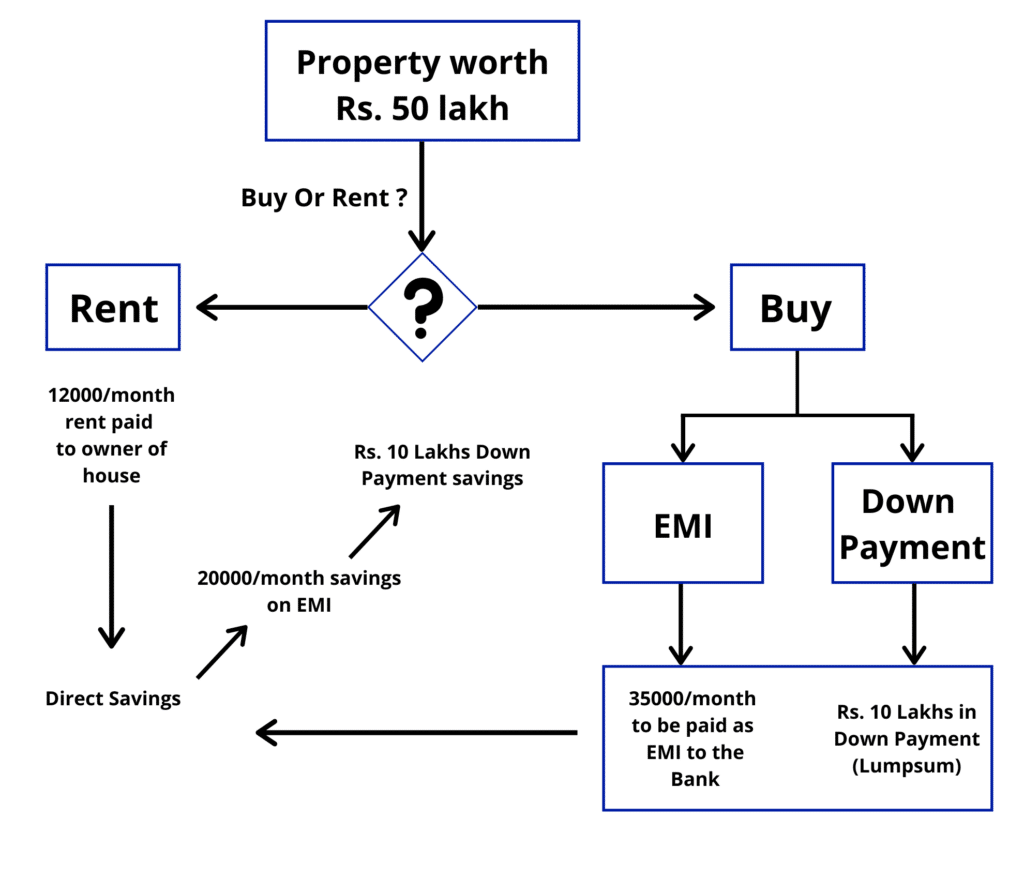

Suppose there is a real estate property in Mumbai. Its property value as of today is Rs 50 lakh. Assuming you buy or rent this property today, let’s see how both the scenarios turn out to be:

If You Rent: If you decide to rent the property, your immediate monthly expenses will be Rs 12,000. This will be your monthly rent which will increase every year by approximately 8%.

If You Buy: If you decide to buy the property, your monthly expenses will be Rs 35,000 for 20 years which is your EMI.

Buying your house will cost you 2.88 times renting it on a monthly basis. Plus an additional down payment of Rs 10 lakh would be needed when buying a house.

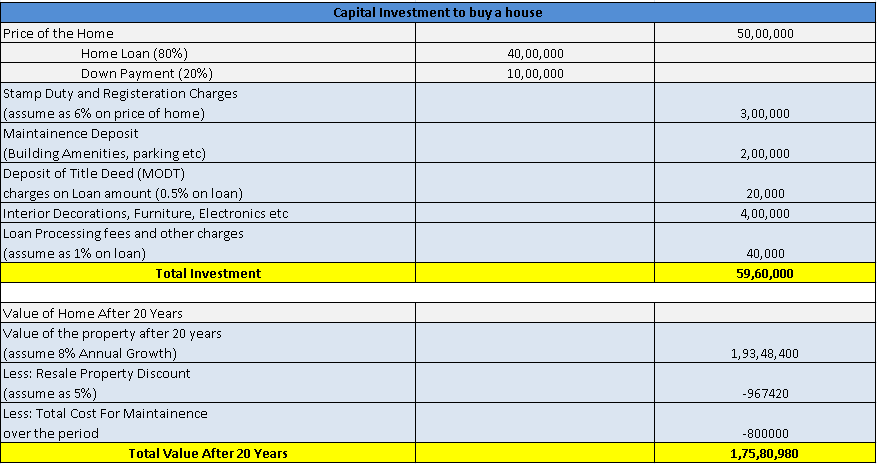

But that’s not it. When you buy a house, there are additional expenses involved which increase the total cost of buying the house.

Below is a table to consider those costs and then let’s interpret the results of whether we should rent or buy this property.

From the above example, we can observe that the Total Investment required to own a property is Rs 59,60,000. After 20 years your property will be worth Rs 1,75,80,980 assuming an 8% appreciation in home prices year over year.

Now there are two steps to find out if we should buy or rent.

The First step is to add the down-payment amount with the additional cost for purchasing the house upfront (10,00,000 + 9,60,000= 19,60,000) and calculate its Investment returns.

The second step is to calculate the investment returns of the difference between Regular payments to the bank (EMI) and Rent(if you rented the house) during 20 years of time.

In this example return on investment for the first step is considered to be 12% every year over 20 years and return on investment for the Second Step is considered 14%. Let us see how the investments turn out to be under these circumstances.

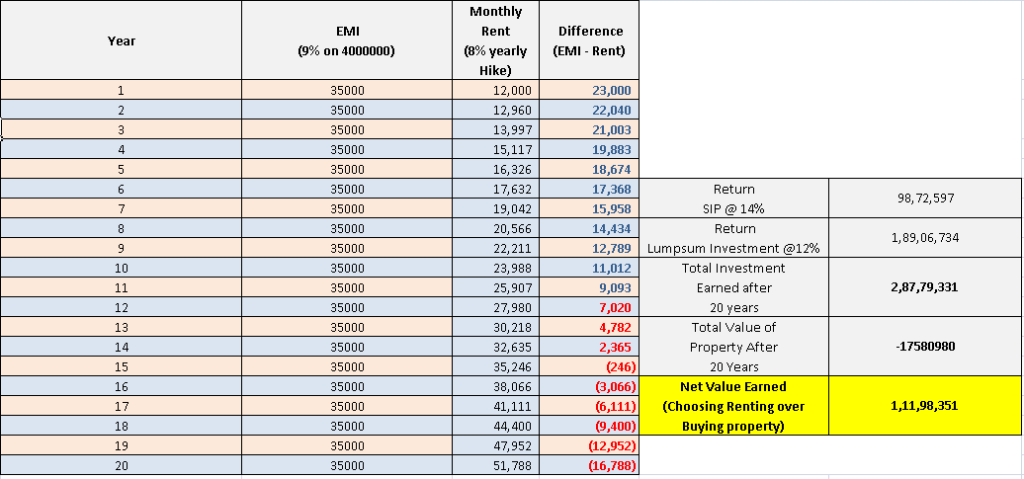

From the above table, we can easily say that renting is a better option in this case.

You can see that the difference between renting and buying decreases as time passes. The difference is negative after 11 years but the net value earned is much better in comparison. Sip amount taken is the average of the “Difference column” at 14% year over year.

However the same may or may not be true in all market conditions. Indian Real Estate Market is dynamic and volatile but it isn’t going to get any cheaper anytime soon.

The only way you decide whether you should Rent or Buy a house depends on your feelings towards the house, the advantages of renting and buying and the most important step is calculating the amounts correctly.

If the property you are going to buy gives you a better return over 20 years than renting it (use the exact formula I used above to decide between the two options), then you should definitely prefer buying your house.

But if renting the house gives you a better mathematical result, you should go for it. I suggest you take a close look and value your need for a house, assess your requirements, and make a final call.

Buying a house isn’t a bad thing, it gives you a feeling of pride and I believe everyone should buy a home at some point in their life. But be sure that it doesn’t cause financial burdens on your shoulders

This table clearly shows us that renting is much better than buying, but what if you stay in a locality where real estate prices aren’t so high?

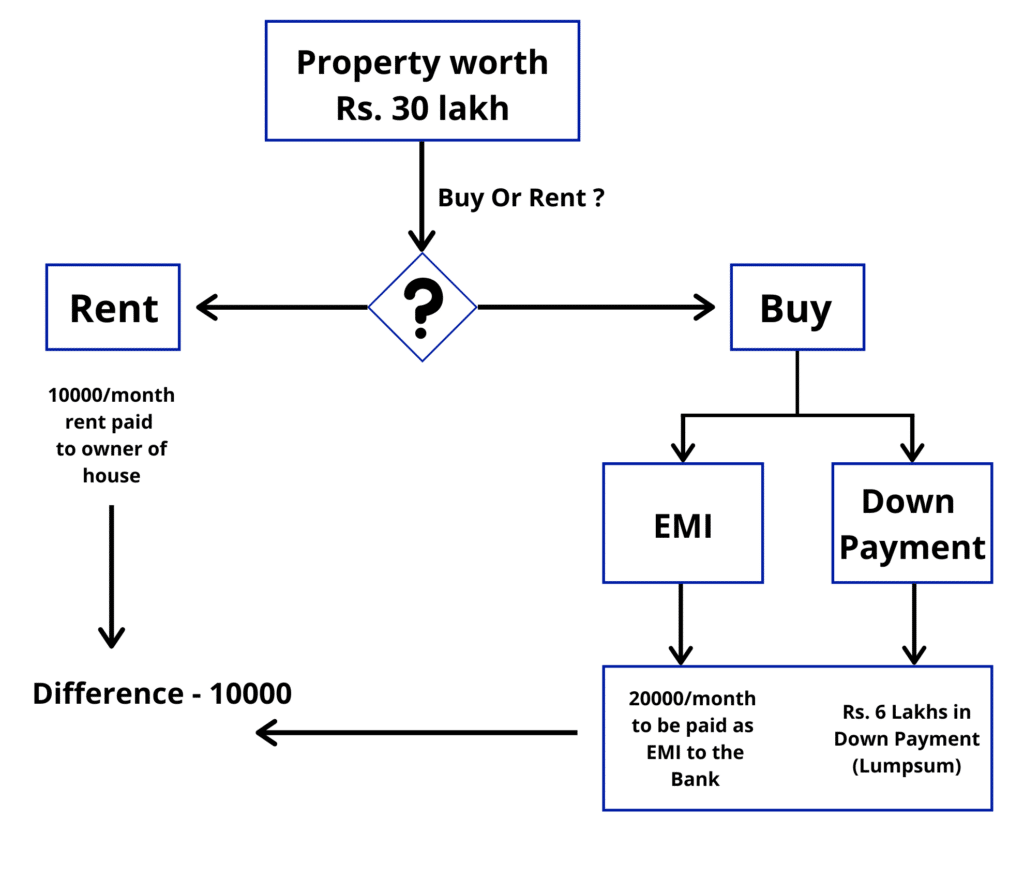

Let’s see another comparison, this time the property value is Rs 30 lakh (Tier-2 and Tier-3 cities).

Rent Or Buy Example 2

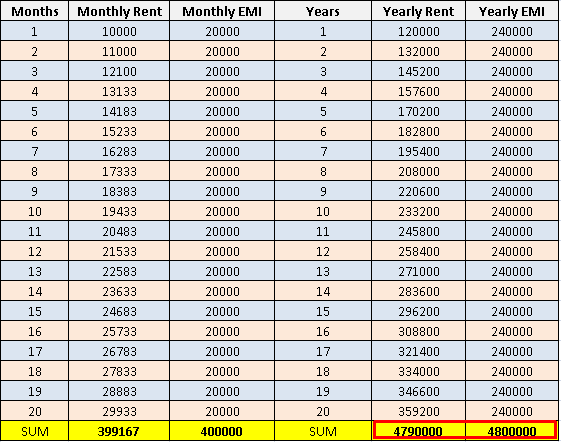

Rent: Now if you decide to rent the property, your monthly rent will be Rs 10,000 which will increase every year by approximately 10%.

Buy: If you buy this property, down payment will be Rs 6 Lakh plus your monthly loan amount will be approximately Rs 20,000.

Let’s calculate to see which option is better.

The Total Money you’ll spend if you buy the property will be Rs 48 lakh and if you would rent, it would be Rs 47.9 lakh.

If you see the final amount you pay at the end of 20 years has a difference of only Rs 10,000. Then why should you prefer buying in this scenario?

At the end of 20 years,

If you rent = You will own nothing and will pay Rs 47,90,000

If you Buy = You will own a house worth Rs 1.1 Crore (considered appreciation @ 7% p.a.) and you will pay Rs 48,00,000.

Thus under such circumstances, buying a home seems to be an appropriate decision.

Thus we can likely make a better choice deciding whether to Rent or to Buy.

The Bottom Line

So is the long-lasting debate on Renting vs. Buying a property settled?

The simple answer to this complex life-changing problem is:

If your math says the value of the property when purchased is greater than the value of investments done in that period, it’s better to buy the house.

If your math says the value of the property when purchased is less than the value of investments done in that period, it’s better to rent the house.

Don’t be upset if you choose to settle for renting the house; you can always buy a house in the future once your income increases and expenses decrease. For that, you need to learn about your finances and learn to budget.

Would you prefer to rent a house or buy a house? Share your views in the comments below.

Have you enjoyed this post? If so, you might want to subscribe to my newsletter. It usually contains life lessons and money-related topics, some interesting observations, links to articles or books I’ve read, and tips to be a better person. If you’re interested in these things then subscribing will be simply wonderful 🙂 PS: Subscribe and Get your Freebie below!

Also, I’m a YouTuber now! If you’re interested in Pinterest Marketing, Blogging, or business-related things, Subscribe to my Channel and I’ll see you in the comments!